10 Mistakes to Avoid When Renting an Apartment

Renting an apartment is a significant decision that involves many considerations. Whether you are a seasoned renter or a first-time tenant, it's essential to approach the rental process with caution and preparation. By understanding common pitfalls, you can ensure a more pleasant and secure living experience.

Mistake 1: Not Doing Enough Research

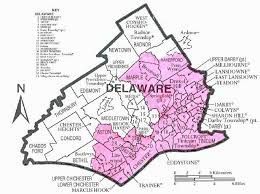

Understanding the Market: The first step to a successful rental experience is to thoroughly understand the market. Prices can vary dramatically between neighborhoods. For example, renting in Center City might cost significantly more than in more residential areas like Roxborough or Manayunk. Use online tools and resources to get a sense of the average rent in different areas.

Neighborhood Dynamics: Each Philadelphia neighborhood has its own character and amenities. While areas like Rittenhouse Square are near major shopping and dining hubs, others like Germantown offer a quieter, more suburban feel. Consider what is important to you, such as proximity to public transportation, schools, parks, and grocery stores.

Mistake 2: Overlooking Total Living Costs

Utilities and Extras: Beyond just rent, consider other costs such as utilities (electricity, water, gas), internet, and cable, which may or may not be included in the rental price. Some buildings also charge extra for parking or have higher energy costs due to poor insulation.

Transportation Costs: If you’re working or studying far from your intended neighborhood, commuting costs can add up. Philadelphia has a robust public transit system, SEPTA, which can be a cheaper alternative to driving. Consider the proximity to SEPTA stations when renting.

Mistake 3: Renting Without Seeing the Property

Seeing is Believing: Online listings can be misleading. Photos might be outdated or selectively taken. Make it a point to visit any potential rental properties in person. This allows you to check for issues like natural light, noise levels, and general upkeep.

Safety Checks: During your visit, assess the safety of the neighborhood. Does it feel safe to walk around at night? Are there security systems in place in the building? Check for functioning smoke detectors and fire escape routes in older buildings.

Mistake 4: Not Reading the Lease Carefully

Understand Every Clause: The lease is a legally binding document that details your rights and responsibilities as a tenant, as well as those of the landlord. Understand clauses related to lease termination, rent increases, subletting policies, and penalties for breaking the lease early.

Deposit Details: Ensure the lease clearly outlines the conditions under which your deposit is fully refundable. Common conditions for withholding deposits include damage to the property and unpaid rent. Document the property's initial condition with time-stamped photos as a reference.

Mistake 5: Underestimating the Importance of Communication

Responsiveness: A responsive landlord can make apartment living much more pleasant. Before signing the lease, try to gauge the landlord’s responsiveness to maintenance requests or emergency situations. You can ask current tenants about their experiences or check online reviews.

Mistake 6: Not Accounting for Roommates

Set Clear Expectations: If sharing your apartment, it’s essential to establish clear rules regarding rent, utilities, chores, and guest policies. Misunderstandings can lead to disputes which can disrupt your living situation. Ensure that all roommates agree to the terms set out in the lease to avoid legal and financial complications.

Legal Responsibility: Understand that with most leases, all tenants are jointly and severally liable for rent and damages. This means if one roommate fails to pay their share, the other roommates are legally responsible to cover the shortfall.

Mistake 7: Rushing the Decision Process

Take Your Time: The pressure to secure an apartment quickly can lead to poor decision-making. Give yourself enough time to compare different options, consider the best time of year to rent, and negotiate terms if possible. Rushing can lead to overlooking potential issues with the apartment or the lease agreement.

Mistake 8: Not Prioritizing Proper Documentation

Document Everything: When moving in, take detailed notes and photographs of the apartment’s condition. This documentation will be crucial when moving out to ensure you receive your full deposit back. It also serves as evidence if disputes over damages arise.

Mistake 9: Underestimating Additional Expenses

Consider All Costs: Many renters focus solely on the monthly rent without considering other expenses like commuting costs, lifestyle needs, and the potential increases in rent over time. Make sure you have a comprehensive understanding of all costs involved and how they fit into your budget.

Mistake 10: Not Getting Renters Insurance

Liability: Renters insurance covers the cost of replacing your belongings in the event they are damaged, destroyed, or stolen. Without insurance, you would be responsible for financing the replacement of all your possessions out of pocket if they are lost due to fire, theft, vandalism, or other covered disasters. This can be financially crippling, especially if high-value items like electronics, jewelry, or furniture are involved.

Conclusion

Renting an apartment involves several important steps and considerations. By avoiding these common mistakes, you can protect yourself from unexpected costs and legal issues, ensuring a more enjoyable and stress-free renting experience. Remember, thorough research, careful planning, and clear communication are your best tools when navigating the rental market. Currently looking for your next apartment? Check out our rental services here .