How to Get Your Real Estate License in Pennsylvania

September 16, 2024

How to Get Your Real Estate License in Pennsylvania

New Age Realty Group, Inc.

September 16, 2024

Pennsylvania’s real estate market offers numerous opportunities for those looking to build a career in the industry. Whether you want to help buyers find their dream homes or assist sellers in making profitable investments, getting a real estate license is your first step. This guide will walk you through the steps to obtaining your real estate license in Pennsylvania, providing you with the knowledge and resources to kickstart your career.

Before you can begin the process of getting licensed, you must meet the basic eligibility requirements set by the Pennsylvania Real Estate Commission. Here’s what you need:

Pennsylvania requires all prospective real estate agents to complete a specific number of pre-licensing education hours before they can sit for the licensing exam. You must complete 75 hours of real estate education from an accredited provider. This coursework is divided into two main parts:

You have two main options when it comes to completing your pre-licensing education:

Make sure that the school you choose is approved by the Pennsylvania Real Estate Commission (PREC). You can find a list of approved schools on the PREC website.

Once you've completed your 75 hours of education, it's time to take the Pennsylvania Real Estate Licensing Exam, which is administered by PSI, a third-party testing service. The exam is split into two parts:

To schedule your exam, visit the PSI Exams website, where you can choose your test date and location. You’ll need to pay the exam fee when you register. The cost for the Pennsylvania real estate exam is $49.

Pennsylvania requires all real estate license applicants to complete a background check. The Pennsylvania State Police use the PATCH (Pennsylvania Access to Criminal History) system to conduct background checks. To complete this step:

If you have a criminal record, your application might face delays or require additional review by the Pennsylvania Real Estate Commission. However, a criminal record does not necessarily disqualify you from obtaining a real estate license; the commission reviews applications on a case-by-case basis.

Once you’ve passed the exam and completed your background check, you’re ready to apply for your real estate license. Pennsylvania uses the PALS (Pennsylvania Licensing System) for all real estate license applications. Follow these steps to complete the process:

After submitting your application and paying the fee, the Pennsylvania Real Estate Commission will review your materials. Once approved, you will be issued your real estate license, allowing you to legally practice as a real estate agent in Pennsylvania.

Once you’re licensed, you’ll need to stay on top of maintaining your credentials. Pennsylvania requires that real estate agents renew their licenses every two years. Renewal involves completing 14 hours of continuing education during each renewal period.

Renewal takes place through the PALS system, and you’ll need to pay a renewal fee. Currently, the renewal fee for real estate salespersons in Pennsylvania is $96.

With your license in hand, you can now officially start your career as a real estate agent. Success in real estate comes from continuous learning, dedication, and strategic networking. Here are some tips to help you get started:

Conclusion

Becoming a licensed real estate agent in Pennsylvania is a rewarding process that can lead to a lucrative and fulfilling career. From meeting the basic requirements and completing pre-licensing education to passing the exam and finding the right brokerage, every step is a valuable part of your journey. Stay focused, work hard, and continue learning, and you’ll be well on your way to success in Pennsylvania’s real estate market. Once you get your license, consider joining a close-knit team like New Age Realty Group , where you will grow and thrive instead of getting lost in the crowd.

Step 1: Meet Basic Eligibility Requirements

Before you can begin the process of getting licensed, you must meet the basic eligibility requirements set by the Pennsylvania Real Estate Commission. Here’s what you need:

- Age: You must be at least 18 years old.

- Education: You must have a high school diploma or an equivalent (such as a GED).

Step 2: Complete Required Pre-Licensing Education

Pennsylvania requires all prospective real estate agents to complete a specific number of pre-licensing education hours before they can sit for the licensing exam. You must complete 75 hours of real estate education from an accredited provider. This coursework is divided into two main parts:

- Real Estate Fundamentals (30 hours): This course covers the basics of real estate law, property rights, and ownership principles. You’ll learn key terminology and foundational concepts essential for success in real estate.

- Real Estate Practice (45 hours): This course is more hands-on, focusing on the daily operations of a real estate agent, including listing and selling properties, real estate contracts, and ethical considerations.

Choosing a Pre-Licensing School

You have two main options when it comes to completing your pre-licensing education:

- Online Schools: Ideal for those who need flexibility. You can complete the coursework at your own pace.

- In-Person Schools: Some people prefer a traditional classroom setting, which allows for real-time interaction with instructors and peers.

Make sure that the school you choose is approved by the Pennsylvania Real Estate Commission (PREC). You can find a list of approved schools on the PREC website.

Study Tips

- Take Notes: Write down key points during your courses to help reinforce what you learn.

- Practice Tests: Many schools offer practice exams, which are useful for getting comfortable with the types of questions you'll face.

- Review Regularly: Don’t wait until the last minute to cram. Review your notes and course materials regularly.

Step 3: Pass the Pennsylvania Real Estate Exam

Once you've completed your 75 hours of education, it's time to take the Pennsylvania Real Estate Licensing Exam, which is administered by PSI, a third-party testing service. The exam is split into two parts:

- National Portion: This section consists of 80 multiple-choice questions that cover general real estate principles and practices.

- State Portion: This section contains 30 multiple-choice questions specific to Pennsylvania’s real estate laws and regulations.

What to Expect on Exam Day

- Time Limit: You will have 120 minutes for the national portion and 60 minutes for the state portion.

- Passing Score: You need to score at least 75% on both sections to pass.

- Location: PSI offers testing centers throughout Pennsylvania, and you can also opt for online proctored exams.

Study Tips for the Exam

- Review Course Materials: Focus on both the fundamentals and practice courses, as both will be covered in the exam.

- Use Study Guides: Many real estate schools offer study guides and exam prep courses to help you review essential topics.

- Take Practice Tests: Get familiar with the exam format by taking practice tests that simulate the actual test environment.

Scheduling the Exam

Step 4: Complete a Background Check

Pennsylvania requires all real estate license applicants to complete a background check. The Pennsylvania State Police use the PATCH (Pennsylvania Access to Criminal History) system to conduct background checks. To complete this step:

- Visit the PATCH website and fill out the required forms.

- The cost for a background check is approximately $22.

- You will receive your background check results almost immediately online.

If you have a criminal record, your application might face delays or require additional review by the Pennsylvania Real Estate Commission. However, a criminal record does not necessarily disqualify you from obtaining a real estate license; the commission reviews applications on a case-by-case basis.

Step 5: Submit Your License Application

Once you’ve passed the exam and completed your background check, you’re ready to apply for your real estate license. Pennsylvania uses the PALS (Pennsylvania Licensing System) for all real estate license applications. Follow these steps to complete the process:

- Create a PALS Account: Visit the Pennsylvania Department of State’s website and create an account in the PALS system.

- Complete the Application: You’ll need to upload your exam results, background check, and proof of pre-licensing education. Be sure to fill out all sections of the application accurately.

- Pay the Application Fee: The application fee for a Pennsylvania real estate salesperson license is $107.

- Choose a Sponsoring Broker: In Pennsylvania, you cannot activate your real estate license without being affiliated with a licensed real estate broker. You’ll need to enter the information for your sponsoring broker during the application process.

What to Look for in a Sponsoring Broker

- Training and Support: Find a brokerage that offers robust training and mentorship programs, especially if you’re new to real estate.

- Commission Split: Different brokers offer different commission splits. Some may offer higher splits but require agents to pay for office fees, while others might offer more support with a lower split.

- Company Culture: Choose a brokerage that aligns with your personal and professional goals. Some brokerages may focus on high-volume transactions, while others might prioritize a more client-centered approach.

After submitting your application and paying the fee, the Pennsylvania Real Estate Commission will review your materials. Once approved, you will be issued your real estate license, allowing you to legally practice as a real estate agent in Pennsylvania.

Step 6: Maintain and Renew Your License

Once you’re licensed, you’ll need to stay on top of maintaining your credentials. Pennsylvania requires that real estate agents renew their licenses every two years. Renewal involves completing 14 hours of continuing education during each renewal period.

Continuing Education Requirements

Your continuing education must be completed through a Pennsylvania Real Estate Commission-approved provider. The topics may include updates on real estate law, ethics, and industry practices. Some brokers may also offer in-house continuing education classes, so it’s worth checking if your sponsoring broker provides this benefit.

License Renewal

Step 7: Build Your Real Estate Career in Pennsylvania

With your license in hand, you can now officially start your career as a real estate agent. Success in real estate comes from continuous learning, dedication, and strategic networking. Here are some tips to help you get started:

- Create a Marketing Plan: Start marketing yourself to potential clients through social media, email marketing, and networking events. Building an online presence through platforms like Instagram, Facebook, LinkedIn, and even TikTok can help you reach new audiences.

- Leverage Your Sphere of Influence: Begin by reaching out to friends, family, and acquaintances who may need real estate services or know someone who does.

- Keep Learning: Stay informed about the Pennsylvania real estate market and trends. Continuing education and attending local industry events can help you remain competitive.

- Use Technology: Utilize real estate tools like customer relationship management (CRM) systems, real estate listing platforms, and virtual tour software to streamline your work and attract more clients.

Conclusion

Becoming a licensed real estate agent in Pennsylvania is a rewarding process that can lead to a lucrative and fulfilling career. From meeting the basic requirements and completing pre-licensing education to passing the exam and finding the right brokerage, every step is a valuable part of your journey. Stay focused, work hard, and continue learning, and you’ll be well on your way to success in Pennsylvania’s real estate market. Once you get your license, consider joining a close-knit team like New Age Realty Group , where you will grow and thrive instead of getting lost in the crowd.

Buying your first home can be an exciting yet overwhelming process, especially when it comes to finding ways to make it affordable. Fortunately, there are several grants and assistance programs available for first-time homebuyers in Pennsylvania that can help make homeownership a reality. These programs offer financial aid in the form of grants, closing cost assistance, and down payment help. Below is a list of grants and assistance programs currently available to first-time buyers in Pennsylvania: Grants and Assistance Programs Available in PA Pennsylvania Housing Finance Agency (PHFA) Keystone Advantage Assistance Loan Program Provides up to $6,000 as down payment or closing cost assistance. Available for borrowers with a PHFA first mortgage. HOMEstead Downpayment and Closing Cost Assistance Loan Offers up to $10,000 in down payment and closing cost assistance. Loan is forgiven over a five-year period, provided the homeowner stays in the home. K-FIT (Keystone Forgivable in Ten Years Loan Program) Provides up to 5% of the lesser of the purchase price or appraised value as down payment and closing cost assistance. Forgiven over ten years, with no repayment required if eligibility requirements are met. FHA, USDA, and VA Loan Programs Offer down payment assistance and more lenient credit requirements. PA-based grant programs can often be paired with these loan types for added affordability. First Front Door Program Offers a grant of up to $5,000 to qualified first-time homebuyers. You must match the grant with your own savings; for every $1 you contribute, $3 is provided. For more detailed information on these grants and eligibility requirements, visit the Pennsylvania Housing Finance Agency (PHFA) website . These programs can help you bridge the gap between renting and owning by providing essential financial assistance. Whether you need help with a down payment or closing costs, there is likely a program to fit your needs as a first-time homebuyer in Pennsylvania. More Grants and Assistance Programs for First-Time Buyers in PA In addition to the Pennsylvania Housing Finance Agency programs, several other grants and assistance programs are available from different agencies and organizations, providing even more opportunities for first-time homebuyers in Pennsylvania: Community Development Block Grant (CDBG) Program Funded by the U.S. Department of Housing and Urban Development (HUD). Provides funding to local governments for affordable housing initiatives, including down payment assistance for low- to moderate-income first-time buyers. Availability and amount vary by municipality, so check with your local city or county government for opportunities. Neighborhood Assistance Program (NAP) Offers tax credits to businesses that invest in affordable housing initiatives, which can help first-time buyers indirectly by funding community housing projects. This program is administered through the Pennsylvania Department of Community and Economic Development (DCED). Federal Home Loan Bank (FHLB) Affordable Housing Programs The First Front Door (FFD) program, offered through FHLB, provides eligible first-time buyers with a grant of up to $5,000 to assist with a down payment and closing costs. Participating lenders and financial institutions provide the funding, so buyers need to work with a participating bank. Local Housing Authorities Various local housing authorities across Pennsylvania offer down payment assistance programs and grants. Examples include the Philadelphia Housing Development Corporation (PHDC), which offers the Philly First Home program that provides up to $10,000 (or 6% of the home purchase price) to assist first-time buyers with down payments and closing costs in Philadelphia. U.S. Department of Agriculture (USDA) Loans and Grants The USDA offers loans and grants to promote homeownership in rural areas of Pennsylvania. Eligible buyers can receive 100% financing, and grants can help cover closing costs or home repairs. Good Neighbor Next Door Program (HUD) This HUD program offers a 50% discount on the list price of a home for teachers, law enforcement officers, firefighters, and emergency medical technicians in designated revitalization areas. Buyers must commit to living in the home for at least 36 months. Housing Counseling Agencies Non-profit agencies in Pennsylvania, like NeighborWorks America affiliates, may offer grants or forgivable loans to assist with down payments or closing costs. These agencies often provide educational courses, which can be a requirement for qualifying for other grant programs. For more information, visit: Pennsylvania Department of Community and Economic Development (DCED) Philadelphia Housing Development Corporation (PHDC) Federal Home Loan Bank (FHLB) With a combination of state, federal, and local grants, first-time buyers in Pennsylvania can save up to $31,000 or more. Whether you're looking to reduce down payment costs, get closing cost assistance, or find affordable financing options, these programs are designed to help make your dream of homeownership come true. Authored by: Armand Gjeka, Realtor Sources: -https://phdcphila.org -https://www.phfa.org -https://dced.pa.gov/ -https://www.fhlb.com/

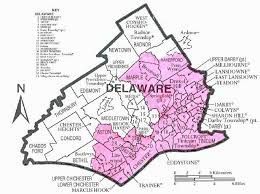

If your Delaware County, PA house is facing foreclosure and you want to avoid it, or if you just need to sell your house quickly for another reason (such as inheriting a house, relocating, losing your job, or if your agent can’t sell your house), then finding a buyer to purchase your Delaware County PA … Continued

Time and money are crucial factors when you are selling your home. If you need to sell your Delaware County house fast, there are local professional home buying companies who pay cash for homes in Delaware County, PA. Let’s explore how you can sell your local Delaware County house quickly and get cash without having … Continued

Foreclosure is a difficult and overwhelming experience for any family facing it, regardless of the reasons behind the situation. Today, we will explore the effects of foreclosure in Delaware County, PA, and what local homeowners should be aware of. We’ll discuss both the impacts of foreclosure and ways to mitigate them. Foreclosure Effects in Delaware … Continued