How to Appeal Your 2024 Philadelphia Property Tax Assessment

September 30, 2024

How to Appeal Your 2024 Philadelphia Property Tax Assessment

New Age Realty Group, Inc.

September 30, 2024

Property taxes in Philadelphia are a significant financial consideration for homeowners, landlords, and investors alike. The city's tax system bases property taxes on the assessment of a property's value, which is determined annually by the Office of Property Assessment (OPA). However, if you believe your property’s assessment is too high and doesn’t reflect its true market value, you have the right to appeal the decision.

Appealing your property tax assessment can potentially reduce your annual tax burden, but the process can be complex. In this post, we’ll walk you through the steps of how to appeal your property taxes in Philadelphia, explain the timeline, and offer tips on gathering the necessary evidence.

Why Appeal Your Property Taxes?

Before diving into the steps, let’s quickly outline why you might want to appeal your property taxes in the first place. Property taxes are based on the OPA's assessment of your property value. If that assessment is inaccurate—say it’s based on outdated data, overlooks significant repair needs, or doesn’t reflect changes in your neighborhood—you could be paying more in taxes than you should. Appealing allows you to challenge that valuation and potentially lower your annual tax bill.

Step 1: Review Your Current Property Assessment

Your first step is to review the current assessed value of your property. You should have received this information from the OPA, either as part of your annual real estate tax bill or through their online portal.

How to Find Your Property's Assessed Value

You can visit the OPA website and look up your property’s current assessed value using your address or BRT number. The assessed value will include both the land value and the building value.

Once you have your property’s assessment, compare it to recent sales prices of comparable properties in your neighborhood. If your property is assessed significantly higher than similar properties or does not account for issues like needed repairs, you may have grounds for an appeal.

Key Questions to Ask

Step 2: Gather Evidence to Support Your Appeal

The success of your appeal largely depends on the quality of the evidence you present. To argue that your property’s assessment is too high, you’ll need to provide documentation showing why it should be lower.

Types of Evidence to Collect

Step 3: File a First-Level Review (FLR) with the OPA

The first step in the formal appeal process is to request a First-Level Review (FLR) with the OPA. This is a relatively informal process where you submit your evidence and reasoning for why your property assessment should be lowered.

How to File a First-Level Review

In your FLR request, you'll need to include:

Once you submit the FLR, the OPA will review your evidence and issue a decision. If they agree with your assessment, they may reduce your property’s valuation, which in turn can lower your tax bill. The OPA typically notifies you of their decision by the fall.

Outcomes of the FLR

Step 4: File an Appeal with the Board of Revision of Taxes (BRT)

If you're not satisfied with the outcome of your First-Level Review, your next step is to file a formal appeal with the Board of Revision of Taxes (BRT). This process is more structured and may involve a formal hearing.

How to File a BRT Appeal

In your BRT appeal, include the same types of evidence as in the FLR but consider providing even more detailed documentation, as this will be a more rigorous review process.

What Happens at the BRT Hearing?

Once your appeal is submitted, the BRT will schedule a hearing, where you’ll have the opportunity to present your case. You can appear in person or send a representative, such as a lawyer or real estate agent.

During the hearing, both you and the city will present evidence. After reviewing the information, the BRT will issue a ruling, either upholding or adjusting your property assessment.

After the Hearing

If the BRT rules in your favor, they will lower your property’s assessment, and you’ll see a reduction in your property tax bill. If they rule against you, your assessment and tax bill will remain the same.

Step 5: Consider Professional Help

While you can handle the appeal process on your own, you may want to consider hiring professional help —especially if you're dealing with a high-value property or complex circumstances.

Who Can Help?

Final Thoughts

Appealing your Philadelphia property taxes can be a time-consuming process, but it can also result in significant savings if successful. By carefully reviewing your property’s assessment, gathering strong evidence, and following the appeal process outlined above, you can potentially lower your property’s valuation and reduce your tax burden.

Remember to be mindful of the deadlines for filing your FLR and BRT appeals, and consider seeking professional assistance if needed. Taking these steps can help ensure that you’re paying only your fair share in property taxes, and not a penny more.

Appealing your property tax assessment can potentially reduce your annual tax burden, but the process can be complex. In this post, we’ll walk you through the steps of how to appeal your property taxes in Philadelphia, explain the timeline, and offer tips on gathering the necessary evidence.

Why Appeal Your Property Taxes?

Before diving into the steps, let’s quickly outline why you might want to appeal your property taxes in the first place. Property taxes are based on the OPA's assessment of your property value. If that assessment is inaccurate—say it’s based on outdated data, overlooks significant repair needs, or doesn’t reflect changes in your neighborhood—you could be paying more in taxes than you should. Appealing allows you to challenge that valuation and potentially lower your annual tax bill.

Step 1: Review Your Current Property Assessment

Your first step is to review the current assessed value of your property. You should have received this information from the OPA, either as part of your annual real estate tax bill or through their online portal.

How to Find Your Property's Assessed Value

You can visit the OPA website and look up your property’s current assessed value using your address or BRT number. The assessed value will include both the land value and the building value.

Once you have your property’s assessment, compare it to recent sales prices of comparable properties in your neighborhood. If your property is assessed significantly higher than similar properties or does not account for issues like needed repairs, you may have grounds for an appeal.

Key Questions to Ask

- Is the assessed value in line with similar properties?

- Does the assessment account for the condition of my property?

- Has there been any major neighborhood change (like new construction or development) that could affect values?

Step 2: Gather Evidence to Support Your Appeal

The success of your appeal largely depends on the quality of the evidence you present. To argue that your property’s assessment is too high, you’ll need to provide documentation showing why it should be lower.

Types of Evidence to Collect

- Recent Sales Data : Gather data on comparable properties (or "comps") in your neighborhood that have recently sold for less than your assessed value. You can find sales data through real estate websites like Zillow, Redfin, or by consulting a local real estate agent. Look for properties with similar square footage, age, condition, and location.

- Property Condition : If your property has structural issues or is in need of major repairs, this can lower its market value. Take detailed photos of any significant damage, such as a leaking roof, cracked foundation, or other problems that affect livability. You may also want to get estimates from contractors for the cost of these repairs to strengthen your case.

- Neighborhood Factors : If your neighborhood has experienced changes that negatively impact property values—such as increased crime rates, nearby construction projects, or other environmental factors—document these issues. Newspaper articles, police reports, or statements from neighbors can all help substantiate your claims.

- Professional Appraisal : Though not required, hiring a professional appraiser to conduct an independent assessment of your property can provide solid evidence in your favor. An appraiser will give you a detailed report on your property’s market value, taking into account its condition, location, and current market trends.

Step 3: File a First-Level Review (FLR) with the OPA

The first step in the formal appeal process is to request a First-Level Review (FLR) with the OPA. This is a relatively informal process where you submit your evidence and reasoning for why your property assessment should be lowered.

How to File a First-Level Review

- You can submit your FLR request online through the OPA’s website or by mail.

- The deadline for filing a First-Level Review is typically in early May of the assessment year. Be sure to check the specific deadline for the current year.

In your FLR request, you'll need to include:

- Basic property information (address, BRT number).

- Your contact details.

- A written explanation of why you believe your property is overvalued.

- Supporting evidence (e.g., photos, sales data, appraisals).

Once you submit the FLR, the OPA will review your evidence and issue a decision. If they agree with your assessment, they may reduce your property’s valuation, which in turn can lower your tax bill. The OPA typically notifies you of their decision by the fall.

Outcomes of the FLR

- Approved: Your property assessment is lowered, and you will receive a new tax bill.

- Rejected: If the OPA does not change your assessment, you can escalate the appeal.

Step 4: File an Appeal with the Board of Revision of Taxes (BRT)

If you're not satisfied with the outcome of your First-Level Review, your next step is to file a formal appeal with the Board of Revision of Taxes (BRT). This process is more structured and may involve a formal hearing.

How to File a BRT Appeal

- You can file a BRT appeal either online or by downloading the appeal form from the BRT website and mailing it in.

- The deadline for filing a BRT appeal is usually October 1 of the tax year. Missing this deadline means you'll have to wait until the following year to appeal again.

In your BRT appeal, include the same types of evidence as in the FLR but consider providing even more detailed documentation, as this will be a more rigorous review process.

What Happens at the BRT Hearing?

Once your appeal is submitted, the BRT will schedule a hearing, where you’ll have the opportunity to present your case. You can appear in person or send a representative, such as a lawyer or real estate agent.

During the hearing, both you and the city will present evidence. After reviewing the information, the BRT will issue a ruling, either upholding or adjusting your property assessment.

After the Hearing

If the BRT rules in your favor, they will lower your property’s assessment, and you’ll see a reduction in your property tax bill. If they rule against you, your assessment and tax bill will remain the same.

Step 5: Consider Professional Help

While you can handle the appeal process on your own, you may want to consider hiring professional help —especially if you're dealing with a high-value property or complex circumstances.

Who Can Help?

- Real Estate Agents : Experienced agents can help you gather comparable sales data and guide you through the appeal process.

- Attorneys : A lawyer with experience in property tax appeals can represent you at the BRT hearing and ensure your rights are protected.

- Appraisers : As mentioned earlier, an independent appraisal can provide credible, unbiased evidence of your property’s true market value.

Final Thoughts

Appealing your Philadelphia property taxes can be a time-consuming process, but it can also result in significant savings if successful. By carefully reviewing your property’s assessment, gathering strong evidence, and following the appeal process outlined above, you can potentially lower your property’s valuation and reduce your tax burden.

Remember to be mindful of the deadlines for filing your FLR and BRT appeals, and consider seeking professional assistance if needed. Taking these steps can help ensure that you’re paying only your fair share in property taxes, and not a penny more.

Buying your first home can be an exciting yet overwhelming process, especially when it comes to finding ways to make it affordable. Fortunately, there are several grants and assistance programs available for first-time homebuyers in Pennsylvania that can help make homeownership a reality. These programs offer financial aid in the form of grants, closing cost assistance, and down payment help. Below is a list of grants and assistance programs currently available to first-time buyers in Pennsylvania: Grants and Assistance Programs Available in PA Pennsylvania Housing Finance Agency (PHFA) Keystone Advantage Assistance Loan Program Provides up to $6,000 as down payment or closing cost assistance. Available for borrowers with a PHFA first mortgage. HOMEstead Downpayment and Closing Cost Assistance Loan Offers up to $10,000 in down payment and closing cost assistance. Loan is forgiven over a five-year period, provided the homeowner stays in the home. K-FIT (Keystone Forgivable in Ten Years Loan Program) Provides up to 5% of the lesser of the purchase price or appraised value as down payment and closing cost assistance. Forgiven over ten years, with no repayment required if eligibility requirements are met. FHA, USDA, and VA Loan Programs Offer down payment assistance and more lenient credit requirements. PA-based grant programs can often be paired with these loan types for added affordability. First Front Door Program Offers a grant of up to $5,000 to qualified first-time homebuyers. You must match the grant with your own savings; for every $1 you contribute, $3 is provided. For more detailed information on these grants and eligibility requirements, visit the Pennsylvania Housing Finance Agency (PHFA) website . These programs can help you bridge the gap between renting and owning by providing essential financial assistance. Whether you need help with a down payment or closing costs, there is likely a program to fit your needs as a first-time homebuyer in Pennsylvania. More Grants and Assistance Programs for First-Time Buyers in PA In addition to the Pennsylvania Housing Finance Agency programs, several other grants and assistance programs are available from different agencies and organizations, providing even more opportunities for first-time homebuyers in Pennsylvania: Community Development Block Grant (CDBG) Program Funded by the U.S. Department of Housing and Urban Development (HUD). Provides funding to local governments for affordable housing initiatives, including down payment assistance for low- to moderate-income first-time buyers. Availability and amount vary by municipality, so check with your local city or county government for opportunities. Neighborhood Assistance Program (NAP) Offers tax credits to businesses that invest in affordable housing initiatives, which can help first-time buyers indirectly by funding community housing projects. This program is administered through the Pennsylvania Department of Community and Economic Development (DCED). Federal Home Loan Bank (FHLB) Affordable Housing Programs The First Front Door (FFD) program, offered through FHLB, provides eligible first-time buyers with a grant of up to $5,000 to assist with a down payment and closing costs. Participating lenders and financial institutions provide the funding, so buyers need to work with a participating bank. Local Housing Authorities Various local housing authorities across Pennsylvania offer down payment assistance programs and grants. Examples include the Philadelphia Housing Development Corporation (PHDC), which offers the Philly First Home program that provides up to $10,000 (or 6% of the home purchase price) to assist first-time buyers with down payments and closing costs in Philadelphia. U.S. Department of Agriculture (USDA) Loans and Grants The USDA offers loans and grants to promote homeownership in rural areas of Pennsylvania. Eligible buyers can receive 100% financing, and grants can help cover closing costs or home repairs. Good Neighbor Next Door Program (HUD) This HUD program offers a 50% discount on the list price of a home for teachers, law enforcement officers, firefighters, and emergency medical technicians in designated revitalization areas. Buyers must commit to living in the home for at least 36 months. Housing Counseling Agencies Non-profit agencies in Pennsylvania, like NeighborWorks America affiliates, may offer grants or forgivable loans to assist with down payments or closing costs. These agencies often provide educational courses, which can be a requirement for qualifying for other grant programs. For more information, visit: Pennsylvania Department of Community and Economic Development (DCED) Philadelphia Housing Development Corporation (PHDC) Federal Home Loan Bank (FHLB) With a combination of state, federal, and local grants, first-time buyers in Pennsylvania can save up to $31,000 or more. Whether you're looking to reduce down payment costs, get closing cost assistance, or find affordable financing options, these programs are designed to help make your dream of homeownership come true. Authored by: Armand Gjeka, Realtor Sources: -https://phdcphila.org -https://www.phfa.org -https://dced.pa.gov/ -https://www.fhlb.com/

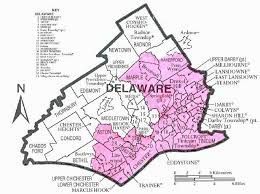

If your Delaware County, PA house is facing foreclosure and you want to avoid it, or if you just need to sell your house quickly for another reason (such as inheriting a house, relocating, losing your job, or if your agent can’t sell your house), then finding a buyer to purchase your Delaware County PA … Continued

Time and money are crucial factors when you are selling your home. If you need to sell your Delaware County house fast, there are local professional home buying companies who pay cash for homes in Delaware County, PA. Let’s explore how you can sell your local Delaware County house quickly and get cash without having … Continued

Foreclosure is a difficult and overwhelming experience for any family facing it, regardless of the reasons behind the situation. Today, we will explore the effects of foreclosure in Delaware County, PA, and what local homeowners should be aware of. We’ll discuss both the impacts of foreclosure and ways to mitigate them. Foreclosure Effects in Delaware … Continued