Airbnb's Contribution to the Housing Crisis

August 26, 2024

Airbnb's Contribution to the Housing Crisis

New Age Realty Group, Inc.

August 26, 2024

The rise of Airbnb has transformed the global travel and hospitality landscape, offering a unique alternative to traditional hotels and vacation rentals. By providing an online platform for homeowners to rent out their properties to short-term guests, Airbnb has given travelers access to a wide range of accommodations, from urban apartments to rural retreats. However, the rapid expansion of Airbnb and similar short-term rental platforms has also had significant implications for the housing market, particularly in cities with high demand for rental properties. This blog post explores the impact of Airbnb on long-term rentals and looks to answer the question of whether or not Airbnb contributes to the housing crisis.

One of the most direct impacts of Airbnb has been the conversion of properties from long-term rentals to short-term rentals. Property owners who might have previously rented their homes or apartments to long-term tenants are increasingly opting to list them on platforms like Airbnb. The allure is clear: short-term rentals often generate higher income compared to traditional long-term leases, especially in popular tourist destinations and cities with high demand for accommodation.

In cities like New York, San Francisco, and Barcelona, the growth of Airbnb has led to a significant reduction in the availability of long-term rental properties. For example, a study by the Urban Politics and Governance research group at McGill University found that in New York City, nearly 12,000 units that could have housed long-term residents were instead listed on Airbnb. This shift has reduced the overall supply of housing available for long-term residents, contributing to tighter rental markets and driving up costs.

As the supply of long-term rental properties diminishes, the demand for those that remain increases, leading to higher rental prices. This trend has been observed in many cities with a high concentration of Airbnb listings. A study conducted by the University of Massachusetts found that in Boston, a 12% increase in Airbnb listings led to a 0.4% increase in rent. While this percentage may seem small, the cumulative effect over time and across various neighborhoods can be substantial.

In cities where housing affordability was already a concern, the impact of Airbnb has exacerbated the situation. Renters, particularly those in lower-income brackets, find themselves competing for a shrinking pool of available housing, often resulting in being priced out of their neighborhoods. This displacement can have far-reaching social and economic consequences, contributing to increased inequality and the loss of community ties.

Airbnb has also been linked to gentrification, particularly in urban neighborhoods that were once affordable but have become desirable to short-term visitors. As property values rise due to the profitability of short-term rentals, long-term residents—often from lower-income or marginalized communities—are increasingly unable to afford their homes. This process of gentrification is accelerated by investors who purchase properties specifically for short-term rental use, driving up real estate prices and altering the character of neighborhoods.

In cities like Lisbon, the proliferation of Airbnb has transformed historic districts into areas dominated by short-term rental properties, often at the expense of local residents. The result is a shift in the demographic and cultural composition of these neighborhoods, as long-term residents are replaced by transient visitors. This not only disrupts the social fabric of communities but also raises concerns about the sustainability of such changes, particularly in cities with limited housing stock.

The housing crisis is a multifaceted issue influenced by various factors, including economic conditions, population growth, and urbanization. However, the rise of Airbnb has undeniably played a role in exacerbating the crisis in many cities. By reducing the supply of housing available for long-term residents and driving up rental prices, Airbnb has contributed to the growing unaffordability of housing in many urban centers.

In some cases, entire neighborhoods have been effectively hollowed out as more properties are converted into short-term rentals. This trend is particularly concerning in cities where affordable housing is already scarce. For example, in Los Angeles, a city already grappling with a severe housing shortage, the rise of short-term rentals has been linked to increased homelessness, as more residents are unable to find affordable housing.

Moreover, the housing crisis is not just about the availability of housing but also about the quality of life for residents. As neighborhoods become dominated by short-term rentals, long-term residents often face disruptions from the constant turnover of visitors, noise, and a lack of community cohesion. This can lead to a decline in the overall livability of these areas, further contributing to the displacement of long-term residents.

Recognizing the impact of Airbnb on long-term rentals and the housing crisis, many cities have implemented regulations to curb the growth of short-term rentals. These regulations vary widely, from restrictions on the number of days a property can be rented out on platforms like Airbnb to requiring hosts to obtain licenses or pay taxes.

In New York City, for instance, strict regulations have been introduced to limit the ability of landlords to list entire apartments on Airbnb unless the host is present, and even then, the rental period cannot exceed 30 days. San Francisco has also implemented regulations that cap the number of nights a property can be rented short-term to 90 days per year, among other restrictions.

While these regulations are designed to protect the availability of long-term rentals and prevent the over-commercialization of residential neighborhoods, their effectiveness has been mixed. Enforcement remains a challenge, with many hosts finding ways to circumvent the rules, such as listing properties under different accounts or using multiple platforms.

Additionally, some critics argue that these regulations may inadvertently harm the sharing economy and reduce income opportunities for property owners, particularly in areas where short-term rentals provide a significant boost to the local economy. Balancing the needs of long-term residents with the economic benefits of short-term rentals remains a complex challenge for policymakers.

Another significant factor in the impact of Airbnb on the housing crisis is the role of investors and corporate hosts. Unlike individual hosts who rent out a spare room or their primary residence, these entities often purchase multiple properties specifically for the purpose of listing them on short-term rental platforms. This practice has led to the commercialization of the Airbnb market, with entire apartment buildings or complexes being converted into short-term rental properties.

In some cities, the presence of corporate hosts has further reduced the availability of affordable housing, as these properties are effectively removed from the long-term rental market. This trend has raised concerns about the commodification of housing and its impact on housing affordability. Critics argue that housing should be treated as a basic human right rather than a commodity to be exploited for profit, and that the rise of corporate hosts on platforms like Airbnb undermines this principle.

As Airbnb and similar platforms continue to grow, their impact on long-term rentals and the housing crisis will likely remain a contentious issue. The future of the industry may depend on how effectively cities can regulate short-term rentals while balancing the interests of property owners, renters, and local communities.

Some cities have started to explore innovative solutions, such as creating designated zones for short-term rentals or requiring that a portion of short-term rental income be reinvested in affordable housing initiatives. Others are considering more radical approaches, such as banning short-term rentals in certain areas altogether.

The challenge for policymakers and communities is to strike a balance that allows for the economic benefits of short-term rentals while protecting the rights of long-term residents and ensuring housing remains affordable and accessible to all.

The impact of the Airbnb industry on long-term rentals and the housing crisis is a complex and multifaceted issue. While Airbnb has provided economic opportunities for property owners and contributed to the growth of tourism, it has also exacerbated housing shortages, increased rental prices, and contributed to the displacement of long-term residents in many cities.

Addressing these challenges requires a nuanced approach that considers the needs of all stakeholders involved. As the housing crisis continues to unfold, it is crucial for policymakers, communities, and industry leaders to engage in ongoing dialogue and work together to find solutions that promote both economic vitality and housing affordability. Only through such collaborative efforts can we hope to mitigate the negative impacts of short-term rentals and ensure that cities remain livable for all residents.

The Shift from Long-Term Rentals to Short-Term Rentals

In cities like New York, San Francisco, and Barcelona, the growth of Airbnb has led to a significant reduction in the availability of long-term rental properties. For example, a study by the Urban Politics and Governance research group at McGill University found that in New York City, nearly 12,000 units that could have housed long-term residents were instead listed on Airbnb. This shift has reduced the overall supply of housing available for long-term residents, contributing to tighter rental markets and driving up costs.

The Impact on Rental Prices

In cities where housing affordability was already a concern, the impact of Airbnb has exacerbated the situation. Renters, particularly those in lower-income brackets, find themselves competing for a shrinking pool of available housing, often resulting in being priced out of their neighborhoods. This displacement can have far-reaching social and economic consequences, contributing to increased inequality and the loss of community ties.

Gentrification and the Changing Fabric of Neighborhoods

In cities like Lisbon, the proliferation of Airbnb has transformed historic districts into areas dominated by short-term rental properties, often at the expense of local residents. The result is a shift in the demographic and cultural composition of these neighborhoods, as long-term residents are replaced by transient visitors. This not only disrupts the social fabric of communities but also raises concerns about the sustainability of such changes, particularly in cities with limited housing stock.

Contribution to the Housing Crisis

In some cases, entire neighborhoods have been effectively hollowed out as more properties are converted into short-term rentals. This trend is particularly concerning in cities where affordable housing is already scarce. For example, in Los Angeles, a city already grappling with a severe housing shortage, the rise of short-term rentals has been linked to increased homelessness, as more residents are unable to find affordable housing.

Moreover, the housing crisis is not just about the availability of housing but also about the quality of life for residents. As neighborhoods become dominated by short-term rentals, long-term residents often face disruptions from the constant turnover of visitors, noise, and a lack of community cohesion. This can lead to a decline in the overall livability of these areas, further contributing to the displacement of long-term residents.

Regulatory Responses and Their Effectiveness

While these regulations are designed to protect the availability of long-term rentals and prevent the over-commercialization of residential neighborhoods, their effectiveness has been mixed. Enforcement remains a challenge, with many hosts finding ways to circumvent the rules, such as listing properties under different accounts or using multiple platforms.

Additionally, some critics argue that these regulations may inadvertently harm the sharing economy and reduce income opportunities for property owners, particularly in areas where short-term rentals provide a significant boost to the local economy. Balancing the needs of long-term residents with the economic benefits of short-term rentals remains a complex challenge for policymakers.

The Role of Investors and Corporate Hosts

In some cities, the presence of corporate hosts has further reduced the availability of affordable housing, as these properties are effectively removed from the long-term rental market. This trend has raised concerns about the commodification of housing and its impact on housing affordability. Critics argue that housing should be treated as a basic human right rather than a commodity to be exploited for profit, and that the rise of corporate hosts on platforms like Airbnb undermines this principle.

The Future of Airbnb and Long-Term Rentals

Some cities have started to explore innovative solutions, such as creating designated zones for short-term rentals or requiring that a portion of short-term rental income be reinvested in affordable housing initiatives. Others are considering more radical approaches, such as banning short-term rentals in certain areas altogether.

The challenge for policymakers and communities is to strike a balance that allows for the economic benefits of short-term rentals while protecting the rights of long-term residents and ensuring housing remains affordable and accessible to all.

A Complex Issue with No Easy Solutions

Addressing these challenges requires a nuanced approach that considers the needs of all stakeholders involved. As the housing crisis continues to unfold, it is crucial for policymakers, communities, and industry leaders to engage in ongoing dialogue and work together to find solutions that promote both economic vitality and housing affordability. Only through such collaborative efforts can we hope to mitigate the negative impacts of short-term rentals and ensure that cities remain livable for all residents.

Buying your first home can be an exciting yet overwhelming process, especially when it comes to finding ways to make it affordable. Fortunately, there are several grants and assistance programs available for first-time homebuyers in Pennsylvania that can help make homeownership a reality. These programs offer financial aid in the form of grants, closing cost assistance, and down payment help. Below is a list of grants and assistance programs currently available to first-time buyers in Pennsylvania: Grants and Assistance Programs Available in PA Pennsylvania Housing Finance Agency (PHFA) Keystone Advantage Assistance Loan Program Provides up to $6,000 as down payment or closing cost assistance. Available for borrowers with a PHFA first mortgage. HOMEstead Downpayment and Closing Cost Assistance Loan Offers up to $10,000 in down payment and closing cost assistance. Loan is forgiven over a five-year period, provided the homeowner stays in the home. K-FIT (Keystone Forgivable in Ten Years Loan Program) Provides up to 5% of the lesser of the purchase price or appraised value as down payment and closing cost assistance. Forgiven over ten years, with no repayment required if eligibility requirements are met. FHA, USDA, and VA Loan Programs Offer down payment assistance and more lenient credit requirements. PA-based grant programs can often be paired with these loan types for added affordability. First Front Door Program Offers a grant of up to $5,000 to qualified first-time homebuyers. You must match the grant with your own savings; for every $1 you contribute, $3 is provided. For more detailed information on these grants and eligibility requirements, visit the Pennsylvania Housing Finance Agency (PHFA) website . These programs can help you bridge the gap between renting and owning by providing essential financial assistance. Whether you need help with a down payment or closing costs, there is likely a program to fit your needs as a first-time homebuyer in Pennsylvania. More Grants and Assistance Programs for First-Time Buyers in PA In addition to the Pennsylvania Housing Finance Agency programs, several other grants and assistance programs are available from different agencies and organizations, providing even more opportunities for first-time homebuyers in Pennsylvania: Community Development Block Grant (CDBG) Program Funded by the U.S. Department of Housing and Urban Development (HUD). Provides funding to local governments for affordable housing initiatives, including down payment assistance for low- to moderate-income first-time buyers. Availability and amount vary by municipality, so check with your local city or county government for opportunities. Neighborhood Assistance Program (NAP) Offers tax credits to businesses that invest in affordable housing initiatives, which can help first-time buyers indirectly by funding community housing projects. This program is administered through the Pennsylvania Department of Community and Economic Development (DCED). Federal Home Loan Bank (FHLB) Affordable Housing Programs The First Front Door (FFD) program, offered through FHLB, provides eligible first-time buyers with a grant of up to $5,000 to assist with a down payment and closing costs. Participating lenders and financial institutions provide the funding, so buyers need to work with a participating bank. Local Housing Authorities Various local housing authorities across Pennsylvania offer down payment assistance programs and grants. Examples include the Philadelphia Housing Development Corporation (PHDC), which offers the Philly First Home program that provides up to $10,000 (or 6% of the home purchase price) to assist first-time buyers with down payments and closing costs in Philadelphia. U.S. Department of Agriculture (USDA) Loans and Grants The USDA offers loans and grants to promote homeownership in rural areas of Pennsylvania. Eligible buyers can receive 100% financing, and grants can help cover closing costs or home repairs. Good Neighbor Next Door Program (HUD) This HUD program offers a 50% discount on the list price of a home for teachers, law enforcement officers, firefighters, and emergency medical technicians in designated revitalization areas. Buyers must commit to living in the home for at least 36 months. Housing Counseling Agencies Non-profit agencies in Pennsylvania, like NeighborWorks America affiliates, may offer grants or forgivable loans to assist with down payments or closing costs. These agencies often provide educational courses, which can be a requirement for qualifying for other grant programs. For more information, visit: Pennsylvania Department of Community and Economic Development (DCED) Philadelphia Housing Development Corporation (PHDC) Federal Home Loan Bank (FHLB) With a combination of state, federal, and local grants, first-time buyers in Pennsylvania can save up to $31,000 or more. Whether you're looking to reduce down payment costs, get closing cost assistance, or find affordable financing options, these programs are designed to help make your dream of homeownership come true. Authored by: Armand Gjeka, Realtor Sources: -https://phdcphila.org -https://www.phfa.org -https://dced.pa.gov/ -https://www.fhlb.com/

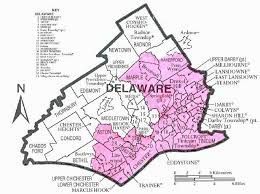

If your Delaware County, PA house is facing foreclosure and you want to avoid it, or if you just need to sell your house quickly for another reason (such as inheriting a house, relocating, losing your job, or if your agent can’t sell your house), then finding a buyer to purchase your Delaware County PA … Continued

Time and money are crucial factors when you are selling your home. If you need to sell your Delaware County house fast, there are local professional home buying companies who pay cash for homes in Delaware County, PA. Let’s explore how you can sell your local Delaware County house quickly and get cash without having … Continued

Foreclosure is a difficult and overwhelming experience for any family facing it, regardless of the reasons behind the situation. Today, we will explore the effects of foreclosure in Delaware County, PA, and what local homeowners should be aware of. We’ll discuss both the impacts of foreclosure and ways to mitigate them. Foreclosure Effects in Delaware … Continued