How Much Money Do You Need to Buy a Home?

July 24, 2024

How Much Money Do You Need to Buy a Home?

Terry Kravaris Mortgage Team at Movement Mortgage

July 24, 2024

Buying a home is one of the most significant financial decisions many people will make in their lifetime. Potential homebuyers must understand their financial situation and the costs associated with purchasing a property. This guide outlines the various financial aspects and provides a detailed answer to the question, "How much money do you need to buy a home?"

Down Payment

Standard Down Payments

The most substantial upfront cost when buying a home is the down payment. Traditionally, lenders require a down payment of 20% of the home's purchase price. For example, on a $300,000 home, a 20% down payment would be $60,000.

Low Down Payment Options

However, not all buyers need to put down 20%. There are various loan programs with lower down payment requirements:

Closing Costs

Closing costs are fees associated with finalizing a mortgage, typically ranging from 3% to 7% of the loan amount based on the area you purchase. These include:

For a $300,000 home, closing costs might range from $6,000 to $21,000.

Prepaid Costs and Escrow Accounts

In addition to closing costs, buyers must often prepay certain expenses and set up escrow accounts for future payments. These can include:

Total Estimated Costs

To provide a clearer picture, let's calculate the total estimated costs for a hypothetical $300,000 home:

Scenario 1: Conventional Loan for a first-time home buyer with 3% Down Payment

Down Payment (3%): $9,000 Closing Costs (4%): $12,000 Prepaid Costs: $4,000 Total Estimated Cost: $25,000

Scenario 2: FHA Loan with 3.5% Down Payment

Down Payment (3.5%): $10,500 Closing Costs (4%): $12,000 Prepaid Costs: $4,000 Total Estimated Cost: $26,500

Scenario 3: Conventional Loan with 20% Down Payment

Down Payment (20%): $60,000 Closing Costs (4%): $12,000 Prepaid Costs: $4,000 Total Estimated Cost: $76,000

Additional Considerations

Property Type and Location

The type and location of the property can significantly impact costs. For instance:

Financial Health

A buyer’s credit score, debt-to-income ratio, and overall financial health influence loan terms, including interest rates and eligibility for different mortgage programs. Improving credit scores and reducing debt can result in better loan offers and lower costs.

Conclusion

Determining how much money is needed to buy a home depends on several factors, including the home's price, loan type, down payment amount, closing costs, prepaid expenses, moving costs, and reserve requirements. As a loan officer, it’s crucial to provide a detailed breakdown to potential homebuyers, ensuring they understand all the associated costs and are well-prepared for this significant financial commitment.

In summary, for a $300,000 home, the total costs can range widely. Each buyer's situation is unique, and a personalized assessment will provide the most accurate estimate. By carefully planning and understanding these costs, homebuyers can make informed decisions and move confidently towards owning their new home.

Down Payment

Standard Down Payments

The most substantial upfront cost when buying a home is the down payment. Traditionally, lenders require a down payment of 20% of the home's purchase price. For example, on a $300,000 home, a 20% down payment would be $60,000.

Low Down Payment Options

However, not all buyers need to put down 20%. There are various loan programs with lower down payment requirements:

- FHA Loans: As low as 3.5%.

- VA Loans: 0% for eligible veterans and active-duty service members.

- USDA Loans: 0% for properties in designated rural areas.

- Conventional Loans: As low as 3% with certain qualifications.

Closing Costs

Closing costs are fees associated with finalizing a mortgage, typically ranging from 3% to 7% of the loan amount based on the area you purchase. These include:

- Loan Origination Fees: Fees charged by the lender for processing the loan.

- Appraisal Fees: The cost of having the home professionally appraised.

- Inspection Fees: Costs for home inspections to assess the property's condition.

- Title Insurance: Protects against disputes over property ownership.

- Attorney Fees: Legal fees for the transaction.

- Recording Fees: Charges for recording the deed with the county.

- Transfer Taxes: Charges from the County and State where you purchase a home.

- Prepaid Costs: Such as property taxes, homeowners insurance, and interest.

For a $300,000 home, closing costs might range from $6,000 to $21,000.

Prepaid Costs and Escrow Accounts

In addition to closing costs, buyers must often prepay certain expenses and set up escrow accounts for future payments. These can include:

- Homeowners Insurance: Typically paid upfront for the first year.

- Property Taxes: A portion may be prepaid at closing.

- Private Mortgage Insurance (PMI): Required if the down payment is less than 20% for conventional loans.

- Escrow Account Setup: Lenders may require setting up an escrow account to cover future property tax and insurance payments.

Total Estimated Costs

To provide a clearer picture, let's calculate the total estimated costs for a hypothetical $300,000 home:

Scenario 1: Conventional Loan for a first-time home buyer with 3% Down Payment

Down Payment (3%): $9,000 Closing Costs (4%): $12,000 Prepaid Costs: $4,000 Total Estimated Cost: $25,000

Scenario 2: FHA Loan with 3.5% Down Payment

Down Payment (3.5%): $10,500 Closing Costs (4%): $12,000 Prepaid Costs: $4,000 Total Estimated Cost: $26,500

Scenario 3: Conventional Loan with 20% Down Payment

Down Payment (20%): $60,000 Closing Costs (4%): $12,000 Prepaid Costs: $4,000 Total Estimated Cost: $76,000

Additional Considerations

Property Type and Location

The type and location of the property can significantly impact costs. For instance:

- Condominiums: Often have homeowners association (HOA) fees.

- New Construction: May have different appraisal and inspection costs.

- Geographic Location: Closing costs, property taxes, and insurance premiums vary by region.

Financial Health

A buyer’s credit score, debt-to-income ratio, and overall financial health influence loan terms, including interest rates and eligibility for different mortgage programs. Improving credit scores and reducing debt can result in better loan offers and lower costs.

Conclusion

Determining how much money is needed to buy a home depends on several factors, including the home's price, loan type, down payment amount, closing costs, prepaid expenses, moving costs, and reserve requirements. As a loan officer, it’s crucial to provide a detailed breakdown to potential homebuyers, ensuring they understand all the associated costs and are well-prepared for this significant financial commitment.

In summary, for a $300,000 home, the total costs can range widely. Each buyer's situation is unique, and a personalized assessment will provide the most accurate estimate. By carefully planning and understanding these costs, homebuyers can make informed decisions and move confidently towards owning their new home.

Buying your first home can be an exciting yet overwhelming process, especially when it comes to finding ways to make it affordable. Fortunately, there are several grants and assistance programs available for first-time homebuyers in Pennsylvania that can help make homeownership a reality. These programs offer financial aid in the form of grants, closing cost assistance, and down payment help. Below is a list of grants and assistance programs currently available to first-time buyers in Pennsylvania: Grants and Assistance Programs Available in PA Pennsylvania Housing Finance Agency (PHFA) Keystone Advantage Assistance Loan Program Provides up to $6,000 as down payment or closing cost assistance. Available for borrowers with a PHFA first mortgage. HOMEstead Downpayment and Closing Cost Assistance Loan Offers up to $10,000 in down payment and closing cost assistance. Loan is forgiven over a five-year period, provided the homeowner stays in the home. K-FIT (Keystone Forgivable in Ten Years Loan Program) Provides up to 5% of the lesser of the purchase price or appraised value as down payment and closing cost assistance. Forgiven over ten years, with no repayment required if eligibility requirements are met. FHA, USDA, and VA Loan Programs Offer down payment assistance and more lenient credit requirements. PA-based grant programs can often be paired with these loan types for added affordability. First Front Door Program Offers a grant of up to $5,000 to qualified first-time homebuyers. You must match the grant with your own savings; for every $1 you contribute, $3 is provided. For more detailed information on these grants and eligibility requirements, visit the Pennsylvania Housing Finance Agency (PHFA) website . These programs can help you bridge the gap between renting and owning by providing essential financial assistance. Whether you need help with a down payment or closing costs, there is likely a program to fit your needs as a first-time homebuyer in Pennsylvania. More Grants and Assistance Programs for First-Time Buyers in PA In addition to the Pennsylvania Housing Finance Agency programs, several other grants and assistance programs are available from different agencies and organizations, providing even more opportunities for first-time homebuyers in Pennsylvania: Community Development Block Grant (CDBG) Program Funded by the U.S. Department of Housing and Urban Development (HUD). Provides funding to local governments for affordable housing initiatives, including down payment assistance for low- to moderate-income first-time buyers. Availability and amount vary by municipality, so check with your local city or county government for opportunities. Neighborhood Assistance Program (NAP) Offers tax credits to businesses that invest in affordable housing initiatives, which can help first-time buyers indirectly by funding community housing projects. This program is administered through the Pennsylvania Department of Community and Economic Development (DCED). Federal Home Loan Bank (FHLB) Affordable Housing Programs The First Front Door (FFD) program, offered through FHLB, provides eligible first-time buyers with a grant of up to $5,000 to assist with a down payment and closing costs. Participating lenders and financial institutions provide the funding, so buyers need to work with a participating bank. Local Housing Authorities Various local housing authorities across Pennsylvania offer down payment assistance programs and grants. Examples include the Philadelphia Housing Development Corporation (PHDC), which offers the Philly First Home program that provides up to $10,000 (or 6% of the home purchase price) to assist first-time buyers with down payments and closing costs in Philadelphia. U.S. Department of Agriculture (USDA) Loans and Grants The USDA offers loans and grants to promote homeownership in rural areas of Pennsylvania. Eligible buyers can receive 100% financing, and grants can help cover closing costs or home repairs. Good Neighbor Next Door Program (HUD) This HUD program offers a 50% discount on the list price of a home for teachers, law enforcement officers, firefighters, and emergency medical technicians in designated revitalization areas. Buyers must commit to living in the home for at least 36 months. Housing Counseling Agencies Non-profit agencies in Pennsylvania, like NeighborWorks America affiliates, may offer grants or forgivable loans to assist with down payments or closing costs. These agencies often provide educational courses, which can be a requirement for qualifying for other grant programs. For more information, visit: Pennsylvania Department of Community and Economic Development (DCED) Philadelphia Housing Development Corporation (PHDC) Federal Home Loan Bank (FHLB) With a combination of state, federal, and local grants, first-time buyers in Pennsylvania can save up to $31,000 or more. Whether you're looking to reduce down payment costs, get closing cost assistance, or find affordable financing options, these programs are designed to help make your dream of homeownership come true. Authored by: Armand Gjeka, Realtor Sources: -https://phdcphila.org -https://www.phfa.org -https://dced.pa.gov/ -https://www.fhlb.com/

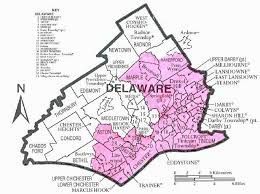

If your Delaware County, PA house is facing foreclosure and you want to avoid it, or if you just need to sell your house quickly for another reason (such as inheriting a house, relocating, losing your job, or if your agent can’t sell your house), then finding a buyer to purchase your Delaware County PA … Continued

Time and money are crucial factors when you are selling your home. If you need to sell your Delaware County house fast, there are local professional home buying companies who pay cash for homes in Delaware County, PA. Let’s explore how you can sell your local Delaware County house quickly and get cash without having … Continued

Foreclosure is a difficult and overwhelming experience for any family facing it, regardless of the reasons behind the situation. Today, we will explore the effects of foreclosure in Delaware County, PA, and what local homeowners should be aware of. We’ll discuss both the impacts of foreclosure and ways to mitigate them. Foreclosure Effects in Delaware … Continued