How COVID-19 Impacted the Real Estate Industry

September 23, 2024

How COVID-19 Impacted the Real Estate Industry

Eric Hanson, Property Manager at New Age

September 23, 2024

The pandemic brought unprecedented challenges to many industries, and real estate was no exception. The ripple effects of business closures, layoffs, and economic uncertainty left many tenants struggling to make ends meet. For property managers and landlords, it meant balancing empathy for tenants in difficult situations while ensuring properties remained profitable. As we reflect on the changes that COVID-19 forced upon the rental market, it’s clear that the landscape has shifted—and continues to evolve.

Here’s a look at some of the key lessons we’ve learned, the adjustments we’ve made, and what it all means for tenants and landlords moving forward.

When the pandemic hit, we saw something we had never encountered before: many tenants, or their parents, had never applied for unemployment benefits. A large portion of these individuals were self-employed, running their own businesses, and hadn’t paid into unemployment. For them, navigating the system was a completely new experience. What was once a hands-off process for property managers became much more involved, as we stepped into the role of financial aid guides—not just for students, but for parents and other tenants trying to access government relief programs.

Our primary goal during this time was to make sure that the funds tenants were eligible for could eventually help them stay current on rent, ultimately benefitting our property owners. We recognized that this was a win-win situation: tenants needed help, and our property owners needed rental income to cover their expenses.

One of the biggest misconceptions during the pandemic was that lease agreements could simply be canceled due to economic hardship. While we understood the struggles tenants were facing, legally, leases remained in effect. This led to some very difficult conversations.

Many tenants called us saying that their universities—whether it was Penn, Drexel, or other local schools—had closed, or that their job had disappeared, and they couldn’t make rent. They wanted to break their leases. Unfortunately, we had to explain that leases are binding contracts, even during a pandemic. While some landlords were willing to work with tenants and let them out of their lease early so the property could be re-rented, others wanted to hold out, knowing that financial assistance could be on the way.

The challenge was balancing empathy for tenants' situations with the reality of managing properties. In many cases, we had to ask landlords what their preferences were—wait for financial assistance or re-list the unit—and take it from there.

The pandemic didn’t just affect leases—it also changed the eviction process significantly. What used to be a relatively quick procedure now stretches over 4 to 6 months, making it critical for property managers to be more selective during the tenant screening process.

Mayor Parker has made rental assistance a permanent part of the city’s budget, ensuring that tenants have access to financial help, which also allows landlords to continue receiving rent. While this has been a welcome relief in many ways, it’s also led to some necessary adjustments in how we approach tenant screening.

With evictions taking months, it’s more important than ever to thoroughly vet tenants before placing them in a unit. We've had to become much more diligent in background checks and income verification. Finding the most qualified tenants from the start helps prevent issues later on, saving time, money, and stress for both landlords and tenants.

Another unexpected challenge? Social media. Platforms like TikTok and Instagram have become hubs for sharing (often inaccurate) information about ways to skirt rental obligations or "hack" the system. Whether it's advice on how to avoid paying rent or tips on how to get out of a lease early, we've seen an uptick in tenants attempting to take these approaches. While most of this information is incorrect, it can still cause confusion and lead to unnecessary disputes.

As a result, we’ve had to stay one step ahead, monitoring trends and adjusting our processes to stay in line with the latest tenant behaviors. We’ve also implemented new software tools to help verify tenant information. One of the most surprising developments has been the rise of falsified or fabricated pay stubs. With templates easily available online, some applicants submit income documents that look legitimate but are completely fake. To combat this, we’ve adopted income verification software to ensure that what we’re seeing is accurate and valid.

All of these changes have led to a more cautious, informed, and proactive approach to property management. Information spreads faster than ever, and both tenants and landlords are more knowledgeable about their rights and responsibilities. For us, that means staying vigilant, continuously adapting to new regulations, and finding ways to make the rental process smoother and more transparent.

We’ve learned that flexibility is key. Whether it's adjusting lease terms, staying on top of financial aid options, or improving tenant screening processes, the ability to pivot and respond quickly to new challenges has been essential.

As the dust settles and we move forward, it’s clear that some of the changes brought about by the pandemic are here to stay. Rental assistance programs have become a permanent part of city budgets, tenant expectations have shifted, and the technology we use to manage properties has evolved.

For landlords and property managers, the focus is now on staying informed, using the right tools, and maintaining open communication with tenants. It's no longer just about finding someone to fill a unit—it’s about finding the right person, ensuring they’re qualified, and being ready to navigate the complexities of today’s rental landscape.

At the end of the day, this new era of property management comes down to staying adaptable, proactive, and above all, committed to providing a smooth and successful experience for everyone involved.

If you're a landlord or tenant navigating the new realities of the rental market, New Age Realty Group is here to help. Whether you need guidance on financial aid, tenant screening, or anything in between, our team is ready to provide support and expertise. Let’s move forward together.

Here’s a look at some of the key lessons we’ve learned, the adjustments we’ve made, and what it all means for tenants and landlords moving forward.

Becoming a Resource for Tenants

When the pandemic hit, we saw something we had never encountered before: many tenants, or their parents, had never applied for unemployment benefits. A large portion of these individuals were self-employed, running their own businesses, and hadn’t paid into unemployment. For them, navigating the system was a completely new experience. What was once a hands-off process for property managers became much more involved, as we stepped into the role of financial aid guides—not just for students, but for parents and other tenants trying to access government relief programs.

Our primary goal during this time was to make sure that the funds tenants were eligible for could eventually help them stay current on rent, ultimately benefitting our property owners. We recognized that this was a win-win situation: tenants needed help, and our property owners needed rental income to cover their expenses.

Lease Agreements Didn’t Go Away

One of the biggest misconceptions during the pandemic was that lease agreements could simply be canceled due to economic hardship. While we understood the struggles tenants were facing, legally, leases remained in effect. This led to some very difficult conversations.

Many tenants called us saying that their universities—whether it was Penn, Drexel, or other local schools—had closed, or that their job had disappeared, and they couldn’t make rent. They wanted to break their leases. Unfortunately, we had to explain that leases are binding contracts, even during a pandemic. While some landlords were willing to work with tenants and let them out of their lease early so the property could be re-rented, others wanted to hold out, knowing that financial assistance could be on the way.

The challenge was balancing empathy for tenants' situations with the reality of managing properties. In many cases, we had to ask landlords what their preferences were—wait for financial assistance or re-list the unit—and take it from there.

A New Era for the Eviction Process

The pandemic didn’t just affect leases—it also changed the eviction process significantly. What used to be a relatively quick procedure now stretches over 4 to 6 months, making it critical for property managers to be more selective during the tenant screening process.

Mayor Parker has made rental assistance a permanent part of the city’s budget, ensuring that tenants have access to financial help, which also allows landlords to continue receiving rent. While this has been a welcome relief in many ways, it’s also led to some necessary adjustments in how we approach tenant screening.

With evictions taking months, it’s more important than ever to thoroughly vet tenants before placing them in a unit. We've had to become much more diligent in background checks and income verification. Finding the most qualified tenants from the start helps prevent issues later on, saving time, money, and stress for both landlords and tenants.

The Influence of Social Media on Tenant Behavior

Another unexpected challenge? Social media. Platforms like TikTok and Instagram have become hubs for sharing (often inaccurate) information about ways to skirt rental obligations or "hack" the system. Whether it's advice on how to avoid paying rent or tips on how to get out of a lease early, we've seen an uptick in tenants attempting to take these approaches. While most of this information is incorrect, it can still cause confusion and lead to unnecessary disputes.

As a result, we’ve had to stay one step ahead, monitoring trends and adjusting our processes to stay in line with the latest tenant behaviors. We’ve also implemented new software tools to help verify tenant information. One of the most surprising developments has been the rise of falsified or fabricated pay stubs. With templates easily available online, some applicants submit income documents that look legitimate but are completely fake. To combat this, we’ve adopted income verification software to ensure that what we’re seeing is accurate and valid.

Adapting to a New Normal

All of these changes have led to a more cautious, informed, and proactive approach to property management. Information spreads faster than ever, and both tenants and landlords are more knowledgeable about their rights and responsibilities. For us, that means staying vigilant, continuously adapting to new regulations, and finding ways to make the rental process smoother and more transparent.

We’ve learned that flexibility is key. Whether it's adjusting lease terms, staying on top of financial aid options, or improving tenant screening processes, the ability to pivot and respond quickly to new challenges has been essential.

What’s Next for the Rental Market?

As the dust settles and we move forward, it’s clear that some of the changes brought about by the pandemic are here to stay. Rental assistance programs have become a permanent part of city budgets, tenant expectations have shifted, and the technology we use to manage properties has evolved.

For landlords and property managers, the focus is now on staying informed, using the right tools, and maintaining open communication with tenants. It's no longer just about finding someone to fill a unit—it’s about finding the right person, ensuring they’re qualified, and being ready to navigate the complexities of today’s rental landscape.

At the end of the day, this new era of property management comes down to staying adaptable, proactive, and above all, committed to providing a smooth and successful experience for everyone involved.

If you're a landlord or tenant navigating the new realities of the rental market, New Age Realty Group is here to help. Whether you need guidance on financial aid, tenant screening, or anything in between, our team is ready to provide support and expertise. Let’s move forward together.

Buying your first home can be an exciting yet overwhelming process, especially when it comes to finding ways to make it affordable. Fortunately, there are several grants and assistance programs available for first-time homebuyers in Pennsylvania that can help make homeownership a reality. These programs offer financial aid in the form of grants, closing cost assistance, and down payment help. Below is a list of grants and assistance programs currently available to first-time buyers in Pennsylvania: Grants and Assistance Programs Available in PA Pennsylvania Housing Finance Agency (PHFA) Keystone Advantage Assistance Loan Program Provides up to $6,000 as down payment or closing cost assistance. Available for borrowers with a PHFA first mortgage. HOMEstead Downpayment and Closing Cost Assistance Loan Offers up to $10,000 in down payment and closing cost assistance. Loan is forgiven over a five-year period, provided the homeowner stays in the home. K-FIT (Keystone Forgivable in Ten Years Loan Program) Provides up to 5% of the lesser of the purchase price or appraised value as down payment and closing cost assistance. Forgiven over ten years, with no repayment required if eligibility requirements are met. FHA, USDA, and VA Loan Programs Offer down payment assistance and more lenient credit requirements. PA-based grant programs can often be paired with these loan types for added affordability. First Front Door Program Offers a grant of up to $5,000 to qualified first-time homebuyers. You must match the grant with your own savings; for every $1 you contribute, $3 is provided. For more detailed information on these grants and eligibility requirements, visit the Pennsylvania Housing Finance Agency (PHFA) website . These programs can help you bridge the gap between renting and owning by providing essential financial assistance. Whether you need help with a down payment or closing costs, there is likely a program to fit your needs as a first-time homebuyer in Pennsylvania. More Grants and Assistance Programs for First-Time Buyers in PA In addition to the Pennsylvania Housing Finance Agency programs, several other grants and assistance programs are available from different agencies and organizations, providing even more opportunities for first-time homebuyers in Pennsylvania: Community Development Block Grant (CDBG) Program Funded by the U.S. Department of Housing and Urban Development (HUD). Provides funding to local governments for affordable housing initiatives, including down payment assistance for low- to moderate-income first-time buyers. Availability and amount vary by municipality, so check with your local city or county government for opportunities. Neighborhood Assistance Program (NAP) Offers tax credits to businesses that invest in affordable housing initiatives, which can help first-time buyers indirectly by funding community housing projects. This program is administered through the Pennsylvania Department of Community and Economic Development (DCED). Federal Home Loan Bank (FHLB) Affordable Housing Programs The First Front Door (FFD) program, offered through FHLB, provides eligible first-time buyers with a grant of up to $5,000 to assist with a down payment and closing costs. Participating lenders and financial institutions provide the funding, so buyers need to work with a participating bank. Local Housing Authorities Various local housing authorities across Pennsylvania offer down payment assistance programs and grants. Examples include the Philadelphia Housing Development Corporation (PHDC), which offers the Philly First Home program that provides up to $10,000 (or 6% of the home purchase price) to assist first-time buyers with down payments and closing costs in Philadelphia. U.S. Department of Agriculture (USDA) Loans and Grants The USDA offers loans and grants to promote homeownership in rural areas of Pennsylvania. Eligible buyers can receive 100% financing, and grants can help cover closing costs or home repairs. Good Neighbor Next Door Program (HUD) This HUD program offers a 50% discount on the list price of a home for teachers, law enforcement officers, firefighters, and emergency medical technicians in designated revitalization areas. Buyers must commit to living in the home for at least 36 months. Housing Counseling Agencies Non-profit agencies in Pennsylvania, like NeighborWorks America affiliates, may offer grants or forgivable loans to assist with down payments or closing costs. These agencies often provide educational courses, which can be a requirement for qualifying for other grant programs. For more information, visit: Pennsylvania Department of Community and Economic Development (DCED) Philadelphia Housing Development Corporation (PHDC) Federal Home Loan Bank (FHLB) With a combination of state, federal, and local grants, first-time buyers in Pennsylvania can save up to $31,000 or more. Whether you're looking to reduce down payment costs, get closing cost assistance, or find affordable financing options, these programs are designed to help make your dream of homeownership come true. Authored by: Armand Gjeka, Realtor Sources: -https://phdcphila.org -https://www.phfa.org -https://dced.pa.gov/ -https://www.fhlb.com/

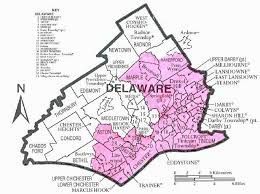

If your Delaware County, PA house is facing foreclosure and you want to avoid it, or if you just need to sell your house quickly for another reason (such as inheriting a house, relocating, losing your job, or if your agent can’t sell your house), then finding a buyer to purchase your Delaware County PA … Continued

Time and money are crucial factors when you are selling your home. If you need to sell your Delaware County house fast, there are local professional home buying companies who pay cash for homes in Delaware County, PA. Let’s explore how you can sell your local Delaware County house quickly and get cash without having … Continued

Foreclosure is a difficult and overwhelming experience for any family facing it, regardless of the reasons behind the situation. Today, we will explore the effects of foreclosure in Delaware County, PA, and what local homeowners should be aware of. We’ll discuss both the impacts of foreclosure and ways to mitigate them. Foreclosure Effects in Delaware … Continued