How Do I Get a Mortgage?

September 9, 2024

How Do I Get a Mortgage?

Terry Kravaris Mortgage Team at Movement Mortgage

September 9, 2024

Securing a mortgage is one of the most significant financial decisions individuals make. During this process the loan officer’s role is to guide their clients through this intricate process, ensuring you understand each step and make informed decisions. Here, we'll outline the journey of obtaining a mortgage, from preparation to closing, offering insights and tips to help prospective homeowners navigate this complex terrain.

Preparing for a Mortgage

Assessing Financial Health

The first step in the mortgage process is to evaluate your financial situation. This involves:

Choosing the Right Mortgage

Mortgage Types

Understanding different mortgage options is essential:

Interest Rates and Terms

Interest rates and loan terms significantly impact the total cost of the mortgage. Compare offers from multiple lenders to find the best rates and terms. Consider the Annual Percentage Rate (APR), which includes interest and other loan-related costs, for a comprehensive comparison.

Pre-Approval Process

Obtaining a mortgage pre-approval strengthens your position as a buyer. It shows sellers you are serious and financially capable, which can be advantageous in competitive markets.

Finding a Home

With a pre-approval letter in hand, start your home search. Work with a real estate agent to find properties within your budget and preferences. Once you find a suitable home, make an offer and negotiate the purchase price.

Mortgage Application and Underwriting

Full Application

After your offer is accepted, complete the full mortgage application. Provide updated financial documents and any additional information the lender requests.

Home Appraisal

The lender will order a home appraisal to determine the property's market value. This ensures the loan amount does not exceed the home's worth, protecting both the lender and borrower.

Underwriting

During underwriting, the lender thoroughly reviews your application and supporting documents. They verify your financial stability, creditworthiness, and the property’s value. The underwriter may request further documentation or clarification during this process.

Loan Approval and Closing

Loan Approval

Once underwriting is complete, you'll receive final loan approval. Review the loan terms carefully, ensuring they align with your expectations and budget.

Closing Disclosure

Three days before closing, you'll receive a Closing Disclosure detailing all loan costs, including interest rates, monthly payments, and closing costs. Review this document thoroughly and ask your lender any questions.

Closing Day

On closing day, you'll sign various documents to finalize the mortgage. This includes the promissory note, mortgage agreement, and deed of trust. Be prepared to pay closing costs, which typically range from 2-5% of the home's purchase price.

Post-Closing

After closing, the lender will disburse the loan funds to the seller, and you will officially own your new home. Set up your mortgage payment schedule and consider setting up automatic payments to ensure timely payments.

Tips for a Smooth Mortgage Process

Obtaining a mortgage is a multifaceted process that requires careful planning, diligent documentation, and informed decision-making. As a loan officer, my goal is to support clients through each stage, ensuring they secure the best possible mortgage for their needs and financial situation. By understanding the process and following these guidelines, prospective homeowners can navigate the mortgage journey with confidence and achieve their dream of homeownership.

Assessing Financial Health

The first step in the mortgage process is to evaluate your financial situation. This involves:

- Credit Score: Your credit score is crucial in determining your mortgage eligibility and interest rate. A higher score generally translates to better loan terms. Before applying, obtain your credit report and address any discrepancies or areas needing improvement.

- Income and Employment: Lenders require proof of stable income. Gather documentation such as pay stubs, tax returns, and employment verification. Consistent employment history, typically over two years, is favorable.

- Debt-to-Income Ratio (DTI): This ratio compares your monthly debt payments to your gross monthly income. A lower DTI indicates better financial health and increases your chances of securing a mortgage. Aim to keep your DTI below 43% (but your DTI can go higher than that under certain loan programs).

- Savings: Accumulate savings for the down payment and other expenses. While the down payment varies (typically 3-20% of the home's price), having additional reserves can cover closing costs and unexpected expenses.

Choosing the Right Mortgage

Mortgage Types

Understanding different mortgage options is essential:

- Fixed-Rate Mortgage: Offers a stable interest rate and monthly payments over the loan term, typically 15, 20, or 30 years. Ideal for those who prefer predictable payments.

- Adjustable-Rate Mortgage (ARM): Has a variable interest rate that changes after an initial fixed period. It may offer lower initial rates but carries the risk of rate increases over time.

- FHA Loans: Insured by the Federal Housing Administration, these loans are designed for first-time buyers and those with lower credit scores. They require a lower down payment (as low as 3.5%).

- VA Loans: Available to veterans and active military personnel, these loans often require no down payment and offer competitive interest rates.

- Conventional Loans: Not insured by the government, these loans typically require higher credit scores and larger down payments but offer more flexibility.

Interest Rates and Terms

Interest rates and loan terms significantly impact the total cost of the mortgage. Compare offers from multiple lenders to find the best rates and terms. Consider the Annual Percentage Rate (APR), which includes interest and other loan-related costs, for a comprehensive comparison.

Pre-Approval Process

Obtaining a mortgage pre-approval strengthens your position as a buyer. It shows sellers you are serious and financially capable, which can be advantageous in competitive markets.

- Application: Complete a mortgage application with your chosen lender, providing detailed financial information.

- Documentation: Submit required documents, including proof of income, tax returns, and asset statements.

- Credit Check: The lender will perform a credit check to assess your creditworthiness.

- Pre-Approval Letter: I f approved, you'll receive a pre-approval letter indicating the loan amount you qualify for. This letter is typically valid for 60-90 days.

Finding a Home

With a pre-approval letter in hand, start your home search. Work with a real estate agent to find properties within your budget and preferences. Once you find a suitable home, make an offer and negotiate the purchase price.

Mortgage Application and Underwriting

Full Application

After your offer is accepted, complete the full mortgage application. Provide updated financial documents and any additional information the lender requests.

Home Appraisal

The lender will order a home appraisal to determine the property's market value. This ensures the loan amount does not exceed the home's worth, protecting both the lender and borrower.

Underwriting

During underwriting, the lender thoroughly reviews your application and supporting documents. They verify your financial stability, creditworthiness, and the property’s value. The underwriter may request further documentation or clarification during this process.

Loan Approval and Closing

Loan Approval

Once underwriting is complete, you'll receive final loan approval. Review the loan terms carefully, ensuring they align with your expectations and budget.

Closing Disclosure

Three days before closing, you'll receive a Closing Disclosure detailing all loan costs, including interest rates, monthly payments, and closing costs. Review this document thoroughly and ask your lender any questions.

Closing Day

On closing day, you'll sign various documents to finalize the mortgage. This includes the promissory note, mortgage agreement, and deed of trust. Be prepared to pay closing costs, which typically range from 2-5% of the home's purchase price.

Post-Closing

After closing, the lender will disburse the loan funds to the seller, and you will officially own your new home. Set up your mortgage payment schedule and consider setting up automatic payments to ensure timely payments.

Tips for a Smooth Mortgage Process

- Stay Organized: Keep all financial documents organized and easily accessible. This will streamline the application and underwriting processes.

- Communicate with Your Lender: Maintain open communication with your lender. Promptly respond to requests for additional information to avoid delays.

- Avoid Major Financial Changes: During the mortgage process, avoid taking on new debt, making large purchases, or changing jobs. Significant financial changes can impact your loan approval.

- Budget for Additional Costs: Besides the down payment and closing costs, budget for moving expenses, home maintenance, and any necessary repairs or upgrades.

- Seek Professional Advice: Consult with a mortgage advisor or financial planner to understand the long-term implications of your mortgage decision.

Obtaining a mortgage is a multifaceted process that requires careful planning, diligent documentation, and informed decision-making. As a loan officer, my goal is to support clients through each stage, ensuring they secure the best possible mortgage for their needs and financial situation. By understanding the process and following these guidelines, prospective homeowners can navigate the mortgage journey with confidence and achieve their dream of homeownership.

Buying your first home can be an exciting yet overwhelming process, especially when it comes to finding ways to make it affordable. Fortunately, there are several grants and assistance programs available for first-time homebuyers in Pennsylvania that can help make homeownership a reality. These programs offer financial aid in the form of grants, closing cost assistance, and down payment help. Below is a list of grants and assistance programs currently available to first-time buyers in Pennsylvania: Grants and Assistance Programs Available in PA Pennsylvania Housing Finance Agency (PHFA) Keystone Advantage Assistance Loan Program Provides up to $6,000 as down payment or closing cost assistance. Available for borrowers with a PHFA first mortgage. HOMEstead Downpayment and Closing Cost Assistance Loan Offers up to $10,000 in down payment and closing cost assistance. Loan is forgiven over a five-year period, provided the homeowner stays in the home. K-FIT (Keystone Forgivable in Ten Years Loan Program) Provides up to 5% of the lesser of the purchase price or appraised value as down payment and closing cost assistance. Forgiven over ten years, with no repayment required if eligibility requirements are met. FHA, USDA, and VA Loan Programs Offer down payment assistance and more lenient credit requirements. PA-based grant programs can often be paired with these loan types for added affordability. First Front Door Program Offers a grant of up to $5,000 to qualified first-time homebuyers. You must match the grant with your own savings; for every $1 you contribute, $3 is provided. For more detailed information on these grants and eligibility requirements, visit the Pennsylvania Housing Finance Agency (PHFA) website . These programs can help you bridge the gap between renting and owning by providing essential financial assistance. Whether you need help with a down payment or closing costs, there is likely a program to fit your needs as a first-time homebuyer in Pennsylvania. More Grants and Assistance Programs for First-Time Buyers in PA In addition to the Pennsylvania Housing Finance Agency programs, several other grants and assistance programs are available from different agencies and organizations, providing even more opportunities for first-time homebuyers in Pennsylvania: Community Development Block Grant (CDBG) Program Funded by the U.S. Department of Housing and Urban Development (HUD). Provides funding to local governments for affordable housing initiatives, including down payment assistance for low- to moderate-income first-time buyers. Availability and amount vary by municipality, so check with your local city or county government for opportunities. Neighborhood Assistance Program (NAP) Offers tax credits to businesses that invest in affordable housing initiatives, which can help first-time buyers indirectly by funding community housing projects. This program is administered through the Pennsylvania Department of Community and Economic Development (DCED). Federal Home Loan Bank (FHLB) Affordable Housing Programs The First Front Door (FFD) program, offered through FHLB, provides eligible first-time buyers with a grant of up to $5,000 to assist with a down payment and closing costs. Participating lenders and financial institutions provide the funding, so buyers need to work with a participating bank. Local Housing Authorities Various local housing authorities across Pennsylvania offer down payment assistance programs and grants. Examples include the Philadelphia Housing Development Corporation (PHDC), which offers the Philly First Home program that provides up to $10,000 (or 6% of the home purchase price) to assist first-time buyers with down payments and closing costs in Philadelphia. U.S. Department of Agriculture (USDA) Loans and Grants The USDA offers loans and grants to promote homeownership in rural areas of Pennsylvania. Eligible buyers can receive 100% financing, and grants can help cover closing costs or home repairs. Good Neighbor Next Door Program (HUD) This HUD program offers a 50% discount on the list price of a home for teachers, law enforcement officers, firefighters, and emergency medical technicians in designated revitalization areas. Buyers must commit to living in the home for at least 36 months. Housing Counseling Agencies Non-profit agencies in Pennsylvania, like NeighborWorks America affiliates, may offer grants or forgivable loans to assist with down payments or closing costs. These agencies often provide educational courses, which can be a requirement for qualifying for other grant programs. For more information, visit: Pennsylvania Department of Community and Economic Development (DCED) Philadelphia Housing Development Corporation (PHDC) Federal Home Loan Bank (FHLB) With a combination of state, federal, and local grants, first-time buyers in Pennsylvania can save up to $31,000 or more. Whether you're looking to reduce down payment costs, get closing cost assistance, or find affordable financing options, these programs are designed to help make your dream of homeownership come true. Authored by: Armand Gjeka, Realtor Sources: -https://phdcphila.org -https://www.phfa.org -https://dced.pa.gov/ -https://www.fhlb.com/

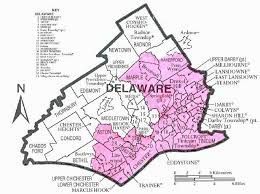

If your Delaware County, PA house is facing foreclosure and you want to avoid it, or if you just need to sell your house quickly for another reason (such as inheriting a house, relocating, losing your job, or if your agent can’t sell your house), then finding a buyer to purchase your Delaware County PA … Continued

Time and money are crucial factors when you are selling your home. If you need to sell your Delaware County house fast, there are local professional home buying companies who pay cash for homes in Delaware County, PA. Let’s explore how you can sell your local Delaware County house quickly and get cash without having … Continued

Foreclosure is a difficult and overwhelming experience for any family facing it, regardless of the reasons behind the situation. Today, we will explore the effects of foreclosure in Delaware County, PA, and what local homeowners should be aware of. We’ll discuss both the impacts of foreclosure and ways to mitigate them. Foreclosure Effects in Delaware … Continued