The Cost of Living in Philadelphia: How It Stacks Up Nationally

May 29, 2024

The Cost of Living in Philadelphia: How It Stacks Up Nationally

New Age Realty Group, Inc.

May 29, 2024

Like any major city, the cost of living is a crucial factor to consider for anyone planning to move to or invest in Philly. According to various sources, the overall cost of living in Philadelphia is approximately 5% higher than the national average. This increase can be attributed to several factors, including housing, utilities, groceries, and transportation. Let's delve into each of these categories to understand where Philadelphia stands.

Housing

Renting in Philadelphia

The cost of housing in Philadelphia varies significantly depending on the neighborhood. For instance, the average rent for a one-bedroom apartment in the city center is around $1,(215) 375-4433 per month, while outside the city center, it drops to approximately $1,(215) 375-4433. For those looking for more space, a three-bedroom apartment in the city center costs about $3,(215) 375-4433 per month, whereas outside the city center, it averages $2,(215) 375-4433.

Buying in Philadelphia

For those interested in purchasing property, the median home price in Philadelphia is about $450,913. This is quite affordable compared to cities like New York or San Francisco. According to Zillow, the average home price in Philadelphia is approximately $220,168, making it a relatively affordable option for homebuyers.

Utilities

Utility costs in Philadelphia are higher than the national average. Residents can expect to pay around $(215) 375-4433 per month for basic utilities, including electricity, heating, cooling, water, and garbage. Additionally, internet costs are about $64.83 per month, bringing the total monthly utility expenses to around $(215) 375-4433.

Groceries

Grocery prices in Philadelphia are notably higher than the national average, by about 17%. Here are some typical prices for common grocery items:

- Loaf of Bread: $4.56

- Gallon of Milk: $2.85

- Carton of Eggs: $2.64

- Bunch of Bananas: $3.94

- Hamburger: $6.02

On average, a single person in Philadelphia spends about $(215) 375-4433 per month on groceries. This can vary depending on dietary preferences and shopping habits.

Transportation

Transportation is a critical aspect of living in any city, and Philadelphia offers a variety of options to get around, whether you prefer public transit, cycling, driving, or walking. The city’s transportation infrastructure is robust, catering to both residents and visitors alike. This section will delve deeper into the transportation costs and options available in Philadelphia, providing a comprehensive overview of what to expect.

Public Transportation - SEPTA

Philadelphia’s public transportation system is managed by the Southeastern Pennsylvania Transportation Authority (SEPTA). SEPTA is one of the largest and most comprehensive transit systems in the United States, serving Philadelphia and the surrounding counties. The network includes buses, subways, trolleys, and commuter rail lines.

Cost of Public Transportation

- Single Ride Fare: $2.50

- Weekly Pass: $25.50

- Monthly Pass: $96.00

SEPTA offers a range of passes that can save frequent riders money. The weekly and monthly passes are particularly beneficial for daily commuters, providing unlimited rides on all SEPTA services within the specified period.

The SEPTA Key Card is an electronic fare payment system that offers convenience and ease of use. Riders can load money or purchase passes on their Key Card, which can be used across all SEPTA services. This system eliminates the need for cash and paper tickets, streamlining the travel experience.

SEPTA’s coverage is extensive, with numerous routes crisscrossing the city and connecting to suburban areas. Key lines include:

- Market-Frankford Line (Blue Line): Running east to west, this subway line connects Northeast Philadelphia to the western suburbs.

- Broad Street Line (Orange Line): Running north to south, this line connects North Philadelphia to South Philadelphia, passing through Center City.

- Regional Rail Lines: These commuter rail lines extend far into the suburbs, offering access to areas like Doylestown, Media, and even parts of New Jersey.

SEPTA also provides services for individuals with disabilities, ensuring that public transportation is accessible to all residents.

Cycling

Philadelphia is increasingly becoming a bike-friendly city, with numerous bike lanes, trails, and a popular bike-sharing program called Indego.

Indego offers both classic and electric bikes, with over 100 stations located throughout the city. It provides an affordable and environmentally friendly way to get around.

Indego Pricing

- Guest Pass (24 Hours): $15.00

- Indego30 Pass (30 Days): $20.00

- Indego365 Pass (Annual): $(215) 375-4433

Philadelphia boasts several dedicated bike lanes and scenic trails, making cycling a convenient and enjoyable mode of transportation. Key routes include:

- Schuylkill River Trail: This popular trail runs along the Schuylkill River, offering a scenic route through the city.

- East/West on Pine and Spruce Streets: These streets have protected bike lanes, making it safer for cyclists to navigate.

- North/South on Delaware Avenue: Connecting South Philadelphia to Fishtown, this route is ideal for commuting and leisure rides.

Driving

For those who prefer driving, Philadelphia’s road network is extensive, although traffic can be challenging during peak hours. Parking can also be an issue in densely populated areas like Center City.

As of the latest data, the average price of a gallon of gas in Philadelphia is around $3.71, which is slightly above the national average.

Parking costs in Philadelphia vary widely depending on the location. In Center City, parking can be quite expensive, with hourly rates ranging from $3 to $6 and daily rates often exceeding $20. Monthly parking rates in prime areas can range from $150 to $300.

Philadelphia is surrounded by several toll roads, including the Pennsylvania Turnpike and the Delaware River bridges, which can add to the cost of driving, especially for commuters from the suburbs.

Walking

Philadelphia’s compact and walkable urban core makes it ideal for pedestrians. Many of the city’s attractions, restaurants, and shops are within walking distance of each other, particularly in neighborhoods like Center City, Old City, and South Street.

Philadelphia ranks high in walkability among major U.S. cities. The grid layout of the streets, coupled with pedestrian-friendly infrastructure, encourages walking as a primary mode of transportation for short distances.

Taxis and Ride-Sharing

For those times when public transit or biking aren’t convenient, Philadelphia offers a range of taxi and ride-sharing services, including Uber and Lyft.

Taxi Fares

- Base Fare: $6.00

- Per Mile: $3.42

Ride-sharing services are widely available and often more affordable than traditional taxis, especially for longer trips. These services offer the added convenience of app-based booking and payment.

Healthcare

Healthcare costs in Philadelphia are slightly lower than the national average, by about 3%. Here are some typical healthcare expenses:

- Doctor's Visit: $(215) 375-4433

- Dentist Visit: $(215) 375-4433

- Optometrist Visit: $(215) 375-4433

- Prescription Drugs: $(215) 375-4433

- Veterinary Visit: $59.98

Childcare

Childcare is a significant expense for families living in Philadelphia. The average monthly cost of full-day private preschool or kindergarten is about $1,475. However, the city offers programs to subsidize childcare costs for eligible families, making it more affordable for some residents.

Entertainment and Dining

Philadelphia offers a rich array of dining and entertainment options. The cost of dining out can vary widely, but on average:

- Meal at an Inexpensive Restaurant: $25.00

- Three-Course Meal for Two at a Mid-Range Restaurant: $75.00

- Fast Food Combo Meal: $9.00

For entertainment, residents can expect to pay:

- Cinema Ticket: $14.00

- Taxi Ride (1 hour): $25.00

Comparison to Other Major Cities

When compared to other major cities in the United States, Philadelphia's cost of living is relatively moderate. For example:

- New York City: The cost of living is about 37% higher than in Philadelphia.

- Los Angeles: The cost of living is approximately 68% higher than in Philadelphia.

- Boston: The cost of living is about 34% higher than in Philadelphia.

- Denver: The cost of living is around 18% higher than in Philadelphia.

- Seattle: The cost of living is about 20% higher than in Philadelphia.

Taxes

Another important consideration is the tax burden. Philadelphia has a combined sales tax rate of 8%, which includes a 6% state tax and an additional 2% city tax. Pennsylvania’s flat income tax rate is 3.07%, one of the lowest in the country.

Conclusion

Philadelphia offers a unique blend of historical significance, cultural richness, and modern amenities. While the cost of living is higher than the national average, it remains more affordable than many other major cities in the United States. Housing costs, although increasing, are still relatively reasonable compared to places like New York or Los Angeles. Utility and grocery expenses are higher, but healthcare costs are slightly lower, providing some balance.

For those considering a move to Philadelphia, it is essential to factor in these costs and compare them to your current expenses and salary. Whether you are drawn by the city's history, diverse neighborhoods, or professional opportunities, understanding the financial landscape will help you make an informed decision about making Philadelphia your new home. Contact New Age Realty Group to help you find your next home or apartment!

Buying your first home can be an exciting yet overwhelming process, especially when it comes to finding ways to make it affordable. Fortunately, there are several grants and assistance programs available for first-time homebuyers in Pennsylvania that can help make homeownership a reality. These programs offer financial aid in the form of grants, closing cost assistance, and down payment help. Below is a list of grants and assistance programs currently available to first-time buyers in Pennsylvania: Grants and Assistance Programs Available in PA Pennsylvania Housing Finance Agency (PHFA) Keystone Advantage Assistance Loan Program Provides up to $6,000 as down payment or closing cost assistance. Available for borrowers with a PHFA first mortgage. HOMEstead Downpayment and Closing Cost Assistance Loan Offers up to $10,000 in down payment and closing cost assistance. Loan is forgiven over a five-year period, provided the homeowner stays in the home. K-FIT (Keystone Forgivable in Ten Years Loan Program) Provides up to 5% of the lesser of the purchase price or appraised value as down payment and closing cost assistance. Forgiven over ten years, with no repayment required if eligibility requirements are met. FHA, USDA, and VA Loan Programs Offer down payment assistance and more lenient credit requirements. PA-based grant programs can often be paired with these loan types for added affordability. First Front Door Program Offers a grant of up to $5,000 to qualified first-time homebuyers. You must match the grant with your own savings; for every $1 you contribute, $3 is provided. For more detailed information on these grants and eligibility requirements, visit the Pennsylvania Housing Finance Agency (PHFA) website . These programs can help you bridge the gap between renting and owning by providing essential financial assistance. Whether you need help with a down payment or closing costs, there is likely a program to fit your needs as a first-time homebuyer in Pennsylvania. More Grants and Assistance Programs for First-Time Buyers in PA In addition to the Pennsylvania Housing Finance Agency programs, several other grants and assistance programs are available from different agencies and organizations, providing even more opportunities for first-time homebuyers in Pennsylvania: Community Development Block Grant (CDBG) Program Funded by the U.S. Department of Housing and Urban Development (HUD). Provides funding to local governments for affordable housing initiatives, including down payment assistance for low- to moderate-income first-time buyers. Availability and amount vary by municipality, so check with your local city or county government for opportunities. Neighborhood Assistance Program (NAP) Offers tax credits to businesses that invest in affordable housing initiatives, which can help first-time buyers indirectly by funding community housing projects. This program is administered through the Pennsylvania Department of Community and Economic Development (DCED). Federal Home Loan Bank (FHLB) Affordable Housing Programs The First Front Door (FFD) program, offered through FHLB, provides eligible first-time buyers with a grant of up to $5,000 to assist with a down payment and closing costs. Participating lenders and financial institutions provide the funding, so buyers need to work with a participating bank. Local Housing Authorities Various local housing authorities across Pennsylvania offer down payment assistance programs and grants. Examples include the Philadelphia Housing Development Corporation (PHDC), which offers the Philly First Home program that provides up to $10,000 (or 6% of the home purchase price) to assist first-time buyers with down payments and closing costs in Philadelphia. U.S. Department of Agriculture (USDA) Loans and Grants The USDA offers loans and grants to promote homeownership in rural areas of Pennsylvania. Eligible buyers can receive 100% financing, and grants can help cover closing costs or home repairs. Good Neighbor Next Door Program (HUD) This HUD program offers a 50% discount on the list price of a home for teachers, law enforcement officers, firefighters, and emergency medical technicians in designated revitalization areas. Buyers must commit to living in the home for at least 36 months. Housing Counseling Agencies Non-profit agencies in Pennsylvania, like NeighborWorks America affiliates, may offer grants or forgivable loans to assist with down payments or closing costs. These agencies often provide educational courses, which can be a requirement for qualifying for other grant programs. For more information, visit: Pennsylvania Department of Community and Economic Development (DCED) Philadelphia Housing Development Corporation (PHDC) Federal Home Loan Bank (FHLB) With a combination of state, federal, and local grants, first-time buyers in Pennsylvania can save up to $31,000 or more. Whether you're looking to reduce down payment costs, get closing cost assistance, or find affordable financing options, these programs are designed to help make your dream of homeownership come true. Authored by: Armand Gjeka, Realtor Sources: -https://phdcphila.org -https://www.phfa.org -https://dced.pa.gov/ -https://www.fhlb.com/

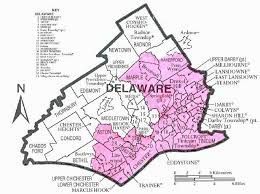

If your Delaware County, PA house is facing foreclosure and you want to avoid it, or if you just need to sell your house quickly for another reason (such as inheriting a house, relocating, losing your job, or if your agent can’t sell your house), then finding a buyer to purchase your Delaware County PA … Continued

Time and money are crucial factors when you are selling your home. If you need to sell your Delaware County house fast, there are local professional home buying companies who pay cash for homes in Delaware County, PA. Let’s explore how you can sell your local Delaware County house quickly and get cash without having … Continued

Foreclosure is a difficult and overwhelming experience for any family facing it, regardless of the reasons behind the situation. Today, we will explore the effects of foreclosure in Delaware County, PA, and what local homeowners should be aware of. We’ll discuss both the impacts of foreclosure and ways to mitigate them. Foreclosure Effects in Delaware … Continued