Impact of the NAR Lawsuit Settlement

April 9, 2024

Impact of the NAR Lawsuit Settlement

New Age Realty Group, Inc.

April 9, 2024

In a landmark development within the real estate sphere, the recent $418 million settlement reached by the National Association of Realtors (NAR) has sent ripples throughout the industry. This decision may very well reshape the landscape of real estate transactions, ushering in an era of more transparency, flexibility, and consumer empowerment.

Understanding the NAR Lawsuit Settlement

The NAR has reached an agreement to settle litigation concerning claims brought on behalf of home sellers regarding broker commissions. The settlement covers over one million NAR members, state/territorial and local associations, association-owned MLSs, and brokerages with an NAR member as principal, with a residential transaction volume in 2022 of $2 billion or below.

Years of legal battles have led to this lawsuit settlement, which represents the largest turning point in real estate practices in decades. At its core, the settlement seeks to address agent commissions, ideally creating a more transparent and flexible way of doing things. The settlement includes the banning of compensating buyer's agents via multiple listing services (MLS) and the requirement for written agreements outlining fees and services between buyer's agents and their clients.

Industry experts anticipate a shift towards lower commissions and a fundamental restructuring of agent-client dynamics. This settlement not only addresses allegations of antitrust violations but also sets the stage for a reimagined real estate marketplace.

Origins of the NAR Lawsuit

The NAR lawsuits can be traced back to the MLS cooperative compensation rule established in the 1990s. While initially aimed at promoting buyer representation, this rule inadvertently contributed to inflated commissions and diminished price competition. Critics argue that passing on agent fees to sellers as part of closing costs stifled competition and inflated costs unreasonably.

Despite NAR’s denials of wrongdoing, the settlement reflects an approach to resolving legal disputes while safeguarding the interests of all parties involved. Nykia Wright, interim CEO of NAR, emphasized the organization's commitment to achieving a balanced resolution that prioritizes consumer choice and upholds market integrity.

What are the Implications for Buyers and Sellers?

The implications of the settlement extend beyond legal technicalities. We are looking at a complete framework shift in real estate transactions. For buyers, newfound autonomy in negotiating agent fees may lead to greater transparency and cost-conscious decision-making. However, first-time homebuyers who already deal will tight budgets and escalating housing prices will now have to factor in their agent’s commission.

Conversely, sellers stand to benefit from reduced commission rates and increased market transparency. The removal of commission disclosures on MLS platforms empowers sellers to make informed decisions about agent representation, fostering a more competitive environment. Adaptability and client-centric service delivery are now even more important in light of these changes.

Industry and Consumer Perspective

There has been mixed response in the industry, given how rapidly the regulatory landscape is evolving. While some view the settlement as good thing in terms of innovation and consumer empowerment, others express concerns about its potential impact on agent livelihoods and market dynamics.

“I think it really impacts states with limited disclosure practices, such as Texas,” says Bob Lynch-Kraley, a seasoned real estate agent at New Age Realty Group. “Pennsylvania has an extensive disclosure practice. At most, it will usher in a much-needed conversation between client and agent. The concern I have is, by eliminating a professional and their expertise, it could give rise to more lawsuits and more defaulted contracts, which in turn harms the consumer.”

Insights reveal that consumers also hold varied views. While some praise the possibility of saving money and giving sellers more control, others worry about extra costs and uncertainties in the market. Many agents have expressed the worry that uniformed buyers who forgo agent representation may get taken advantage of in transactions.

The Effect on Agent-Client Dynamics

At the heart of the settlement lies a change to the traditional agent-client relationship. With buyers empowered to negotiate fees directly and sellers no longer having to deal with commission disclosures, the dynamics of real estate transactions are shifting. In this new landscape, agents must adopt a more value-driven approach, offering tailored solutions that resonate with the needs of the modern consumer.

The New Consumer Experience

In an era defined by digital innovation, technology emerges as a powerful enabler of efficiency and transparency within the real estate ecosystem. From AI-driven property valuation tools to blockchain-enabled transaction platforms, technological advancements can streamline processes and reduce operational overheads. By embracing cutting-edge solutions, real estate agencies can optimize resource allocation and deliver superior value to clients.

As consumer preferences evolve alongside technological advancements, real estate agencies must make changes to their marketing plan and service offerings to remain competitive. Beyond traditional brokerage services, there is a growing demand for integrated solutions encompassing virtual property tours, predictive analytics, and personalized client portals. By embracing a more balanced approach to service delivery, agencies can position themselves as trusted advisors and knowledge leaders in an increasingly complex marketplace.

The opportunity to empower consumers through knowledge and awareness is more present than ever, and real estate agencies can play a pivotal role by offering educational resources and workshops covering the homebuying and selling process. By equipping clients with the information they need to make informed decisions, agencies can foster trust and confidence, laying the foundation for mutually beneficial relationships.

Navigating Regulatory Compliance

In an era of heightened regulatory scrutiny, real estate agencies must remain compliant with the ever-changing legal requirements. From anti-discrimination laws to data privacy regulations, careful attention and adherence are essential. By investing in robust compliance frameworks and legal counsel, agencies can mitigate risk and safeguard their reputation, ensuring ethical and responsible operations.

Looking Ahead: Navigating the New Age of Real Estate

As the real estate industry embraces change, adaptability and innovation are the most important things for real estate professionals to prioritize. By promoting transparency and flexibility, and focusing on the consumer, agencies can successfully navigate this transition. In this new era, real estate professionals can redefine their role, delivering value and empowering consumers in the process.

Understanding the NAR Lawsuit Settlement

The NAR has reached an agreement to settle litigation concerning claims brought on behalf of home sellers regarding broker commissions. The settlement covers over one million NAR members, state/territorial and local associations, association-owned MLSs, and brokerages with an NAR member as principal, with a residential transaction volume in 2022 of $2 billion or below.

Years of legal battles have led to this lawsuit settlement, which represents the largest turning point in real estate practices in decades. At its core, the settlement seeks to address agent commissions, ideally creating a more transparent and flexible way of doing things. The settlement includes the banning of compensating buyer's agents via multiple listing services (MLS) and the requirement for written agreements outlining fees and services between buyer's agents and their clients.

Industry experts anticipate a shift towards lower commissions and a fundamental restructuring of agent-client dynamics. This settlement not only addresses allegations of antitrust violations but also sets the stage for a reimagined real estate marketplace.

Origins of the NAR Lawsuit

The NAR lawsuits can be traced back to the MLS cooperative compensation rule established in the 1990s. While initially aimed at promoting buyer representation, this rule inadvertently contributed to inflated commissions and diminished price competition. Critics argue that passing on agent fees to sellers as part of closing costs stifled competition and inflated costs unreasonably.

Despite NAR’s denials of wrongdoing, the settlement reflects an approach to resolving legal disputes while safeguarding the interests of all parties involved. Nykia Wright, interim CEO of NAR, emphasized the organization's commitment to achieving a balanced resolution that prioritizes consumer choice and upholds market integrity.

What are the Implications for Buyers and Sellers?

The implications of the settlement extend beyond legal technicalities. We are looking at a complete framework shift in real estate transactions. For buyers, newfound autonomy in negotiating agent fees may lead to greater transparency and cost-conscious decision-making. However, first-time homebuyers who already deal will tight budgets and escalating housing prices will now have to factor in their agent’s commission.

Conversely, sellers stand to benefit from reduced commission rates and increased market transparency. The removal of commission disclosures on MLS platforms empowers sellers to make informed decisions about agent representation, fostering a more competitive environment. Adaptability and client-centric service delivery are now even more important in light of these changes.

Industry and Consumer Perspective

There has been mixed response in the industry, given how rapidly the regulatory landscape is evolving. While some view the settlement as good thing in terms of innovation and consumer empowerment, others express concerns about its potential impact on agent livelihoods and market dynamics.

“I think it really impacts states with limited disclosure practices, such as Texas,” says Bob Lynch-Kraley, a seasoned real estate agent at New Age Realty Group. “Pennsylvania has an extensive disclosure practice. At most, it will usher in a much-needed conversation between client and agent. The concern I have is, by eliminating a professional and their expertise, it could give rise to more lawsuits and more defaulted contracts, which in turn harms the consumer.”

Insights reveal that consumers also hold varied views. While some praise the possibility of saving money and giving sellers more control, others worry about extra costs and uncertainties in the market. Many agents have expressed the worry that uniformed buyers who forgo agent representation may get taken advantage of in transactions.

The Effect on Agent-Client Dynamics

At the heart of the settlement lies a change to the traditional agent-client relationship. With buyers empowered to negotiate fees directly and sellers no longer having to deal with commission disclosures, the dynamics of real estate transactions are shifting. In this new landscape, agents must adopt a more value-driven approach, offering tailored solutions that resonate with the needs of the modern consumer.

The New Consumer Experience

In an era defined by digital innovation, technology emerges as a powerful enabler of efficiency and transparency within the real estate ecosystem. From AI-driven property valuation tools to blockchain-enabled transaction platforms, technological advancements can streamline processes and reduce operational overheads. By embracing cutting-edge solutions, real estate agencies can optimize resource allocation and deliver superior value to clients.

As consumer preferences evolve alongside technological advancements, real estate agencies must make changes to their marketing plan and service offerings to remain competitive. Beyond traditional brokerage services, there is a growing demand for integrated solutions encompassing virtual property tours, predictive analytics, and personalized client portals. By embracing a more balanced approach to service delivery, agencies can position themselves as trusted advisors and knowledge leaders in an increasingly complex marketplace.

The opportunity to empower consumers through knowledge and awareness is more present than ever, and real estate agencies can play a pivotal role by offering educational resources and workshops covering the homebuying and selling process. By equipping clients with the information they need to make informed decisions, agencies can foster trust and confidence, laying the foundation for mutually beneficial relationships.

Navigating Regulatory Compliance

In an era of heightened regulatory scrutiny, real estate agencies must remain compliant with the ever-changing legal requirements. From anti-discrimination laws to data privacy regulations, careful attention and adherence are essential. By investing in robust compliance frameworks and legal counsel, agencies can mitigate risk and safeguard their reputation, ensuring ethical and responsible operations.

Looking Ahead: Navigating the New Age of Real Estate

As the real estate industry embraces change, adaptability and innovation are the most important things for real estate professionals to prioritize. By promoting transparency and flexibility, and focusing on the consumer, agencies can successfully navigate this transition. In this new era, real estate professionals can redefine their role, delivering value and empowering consumers in the process.

Buying your first home can be an exciting yet overwhelming process, especially when it comes to finding ways to make it affordable. Fortunately, there are several grants and assistance programs available for first-time homebuyers in Pennsylvania that can help make homeownership a reality. These programs offer financial aid in the form of grants, closing cost assistance, and down payment help. Below is a list of grants and assistance programs currently available to first-time buyers in Pennsylvania: Grants and Assistance Programs Available in PA Pennsylvania Housing Finance Agency (PHFA) Keystone Advantage Assistance Loan Program Provides up to $6,000 as down payment or closing cost assistance. Available for borrowers with a PHFA first mortgage. HOMEstead Downpayment and Closing Cost Assistance Loan Offers up to $10,000 in down payment and closing cost assistance. Loan is forgiven over a five-year period, provided the homeowner stays in the home. K-FIT (Keystone Forgivable in Ten Years Loan Program) Provides up to 5% of the lesser of the purchase price or appraised value as down payment and closing cost assistance. Forgiven over ten years, with no repayment required if eligibility requirements are met. FHA, USDA, and VA Loan Programs Offer down payment assistance and more lenient credit requirements. PA-based grant programs can often be paired with these loan types for added affordability. First Front Door Program Offers a grant of up to $5,000 to qualified first-time homebuyers. You must match the grant with your own savings; for every $1 you contribute, $3 is provided. For more detailed information on these grants and eligibility requirements, visit the Pennsylvania Housing Finance Agency (PHFA) website . These programs can help you bridge the gap between renting and owning by providing essential financial assistance. Whether you need help with a down payment or closing costs, there is likely a program to fit your needs as a first-time homebuyer in Pennsylvania. More Grants and Assistance Programs for First-Time Buyers in PA In addition to the Pennsylvania Housing Finance Agency programs, several other grants and assistance programs are available from different agencies and organizations, providing even more opportunities for first-time homebuyers in Pennsylvania: Community Development Block Grant (CDBG) Program Funded by the U.S. Department of Housing and Urban Development (HUD). Provides funding to local governments for affordable housing initiatives, including down payment assistance for low- to moderate-income first-time buyers. Availability and amount vary by municipality, so check with your local city or county government for opportunities. Neighborhood Assistance Program (NAP) Offers tax credits to businesses that invest in affordable housing initiatives, which can help first-time buyers indirectly by funding community housing projects. This program is administered through the Pennsylvania Department of Community and Economic Development (DCED). Federal Home Loan Bank (FHLB) Affordable Housing Programs The First Front Door (FFD) program, offered through FHLB, provides eligible first-time buyers with a grant of up to $5,000 to assist with a down payment and closing costs. Participating lenders and financial institutions provide the funding, so buyers need to work with a participating bank. Local Housing Authorities Various local housing authorities across Pennsylvania offer down payment assistance programs and grants. Examples include the Philadelphia Housing Development Corporation (PHDC), which offers the Philly First Home program that provides up to $10,000 (or 6% of the home purchase price) to assist first-time buyers with down payments and closing costs in Philadelphia. U.S. Department of Agriculture (USDA) Loans and Grants The USDA offers loans and grants to promote homeownership in rural areas of Pennsylvania. Eligible buyers can receive 100% financing, and grants can help cover closing costs or home repairs. Good Neighbor Next Door Program (HUD) This HUD program offers a 50% discount on the list price of a home for teachers, law enforcement officers, firefighters, and emergency medical technicians in designated revitalization areas. Buyers must commit to living in the home for at least 36 months. Housing Counseling Agencies Non-profit agencies in Pennsylvania, like NeighborWorks America affiliates, may offer grants or forgivable loans to assist with down payments or closing costs. These agencies often provide educational courses, which can be a requirement for qualifying for other grant programs. For more information, visit: Pennsylvania Department of Community and Economic Development (DCED) Philadelphia Housing Development Corporation (PHDC) Federal Home Loan Bank (FHLB) With a combination of state, federal, and local grants, first-time buyers in Pennsylvania can save up to $31,000 or more. Whether you're looking to reduce down payment costs, get closing cost assistance, or find affordable financing options, these programs are designed to help make your dream of homeownership come true. Authored by: Armand Gjeka, Realtor Sources: -https://phdcphila.org -https://www.phfa.org -https://dced.pa.gov/ -https://www.fhlb.com/

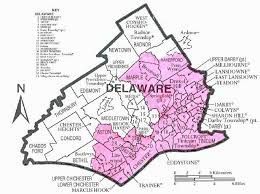

If your Delaware County, PA house is facing foreclosure and you want to avoid it, or if you just need to sell your house quickly for another reason (such as inheriting a house, relocating, losing your job, or if your agent can’t sell your house), then finding a buyer to purchase your Delaware County PA … Continued

Time and money are crucial factors when you are selling your home. If you need to sell your Delaware County house fast, there are local professional home buying companies who pay cash for homes in Delaware County, PA. Let’s explore how you can sell your local Delaware County house quickly and get cash without having … Continued

Foreclosure is a difficult and overwhelming experience for any family facing it, regardless of the reasons behind the situation. Today, we will explore the effects of foreclosure in Delaware County, PA, and what local homeowners should be aware of. We’ll discuss both the impacts of foreclosure and ways to mitigate them. Foreclosure Effects in Delaware … Continued