Navigating Philadelphia Real Estate Taxes: A Comprehensive Guide

February 5, 2024

Navigating Philadelphia Real Estate Taxes: A Comprehensive Guide

New Age Realty Group, Inc.

February 5, 2024

Philadelphia, a city rich in history and culture, is also known for its unique real estate landscape and tax policies. For homeowners and developers alike, understanding the intricacies of Philadelphia's real estate taxes is crucial. In this comprehensive guide, we'll explore the Philadelphia Tax Abatement Program, the city's efforts to fund affordable housing through commercial and industrial tax reductions, and practical solutions for property tax payments, including the Current Year Installment Plan. Additionally, we'll address common questions such as eligibility for senior citizens' property tax benefits and methods to lower property taxes in the city.

Philadelphia Tax Abatement Program: A Catalyst for Development

The Philadelphia Tax Abatement Program, initiated in 2000, aimed to stimulate new development, affordability, and revitalization in the city. For residential property owners, the program historically offered a 10-year 100% tax abatement on improvements related to new construction and rehabilitated properties. However, recent reforms have led to changes in the abatement's structure.

As of December 31, 2021, homeowners can still secure a full 100% tax abatement for 10 years by submitting their applications in time. For applications submitted after January 1, 2022, the abatement will see a 10% reduction each year over the subsequent nine years. This phased-out approach may impact the demand for new construction and rehabilitated properties in the long term. Conversely, it presents short-term opportunities for developers, as individuals rush to take advantage of the 10-year 100% abatement before the deadline.

Commercial & Industrial Tax Abatement: Funding the Neighborhood Preservation Initiative

In parallel with residential tax abatements, commercial and industrial property owners may qualify for a 10-year 100% tax abatement, subject to a 10% reduction. The estimated $83 million generated from this reduction will fund the Neighborhood Preservation Initiative, a $400 million bond program aimed at supporting affordable housing projects, first-time homebuyers, and neighborhood business corridor revitalization.

The initiative is projected to create $2.5 billion in economic activity, generate $71 million in new tax revenues over the first four years, and support 14,700 jobs. This shift in focus towards affordable housing presents a lucrative opportunity for developers to engage in projects that benefit from various subsidies, lowering overall costs.

Philadelphia's Current Year Installment Plan: A Lifeline for Property Owners

For those struggling to meet their yearly property tax obligations, the City of Philadelphia offers a Current Year Installment Plan. This program allows property owners to divide their annual tax bill into affordable monthly payments, preventing the risk of losing their homes due to non-payment. If participants complete the payment plan on time, any accrued interest or penalties will be forgiven.

Seniors and households based on income, regardless of age, can qualify for this program. The deadline to apply is March 31st, and early applications are encouraged to ensure timely processing. The program not only provides financial relief but also ensures automatic re-enrollment each year after approval.

Understanding Property Taxes in Philadelphia: A Holistic Approach

To comprehend the intricacies of property taxes in Philadelphia, it's essential to grasp the basics. Property taxes are assessed and collected by the City of Philadelphia and the School District of Philadelphia, funding various essential services. Real estate tax assessments are based on property value, and taxes are due annually on March 31st. Failure to pay by this deadline incurs penalties, with tax liens filed against the property after December 31st.

For assistance with payment plans or tax-related queries, individuals can contact the City of Philadelphia Revenue Department or consult with a Housing Counseling Agency. The department provides a range of resources, including real estate tax assistance programs, to support homeowners.

Foreclosure Lawsuit & Sheriff’s Sale Process: A Last Resort

In cases of unpaid property taxes, a foreclosure lawsuit may be initiated to foreclose the tax lien, ultimately leading to Sheriff's Sales. Continuous residential occupancy grants original owners the right of redemption within nine months after the new owner's Sheriff's Deed is recorded. Payment plan agreements offer an alternative for taxpayers experiencing financial hardships, allowing them to pay delinquent taxes in installments.

Commonly Asked Questions: A Quick Guide

Several frequently asked questions shed light on various scenarios related to property taxes in Philadelphia:

1. What if I cannot afford to pay my taxes? Payment plans, such as the Owner Occupied Payment Agreement, are available for eligible individuals under the City of Philadelphia's guidelines.

2. What if I never received a tax bill? It is the taxpayer's responsibility to request a tax bill from the City of Philadelphia Revenue Department and ensure the correct mailing address.

3. What if I already paid my taxes? Submit a copy of the paid receipt or canceled check to the City of Philadelphia Revenue Department.

4. What if my taxes were supposed to be paid by my mortgage company? Pay the delinquent tax and contact the mortgage company for reimbursement.

5. What if I receive a tax bill for taxes incurred after selling the property? Notify the Department of Revenue of the ownership change to rectify the issue.

6. What if I have filed bankruptcy and still owe delinquent taxes? Provide a copy of the Bankruptcy Petition to the City of Philadelphia Law Department.

7. How do I get an exemption? Apply for an exemption at the Philadelphia Office of Property Assessment by filling out the necessary forms.

8. "Tax Lien Sale" vs. City Accounts – what is the difference? In 1997, certain tax claims were sold to the Philadelphia Authority for Industrial Development (PAID), impacting the collection process for these accounts.

Conclusion

Navigating Philadelphia's real estate taxes requires a comprehensive understanding of the various programs, abatements, and payment options available to property owners. From the transformative Philadelphia Tax Abatement Program to the lifeline offered by the Current Year Installment Plan, residents have tools to manage their tax obligations. As the city focuses on affordable housing initiatives, developers can capitalize on subsidies and incentives to contribute to the community's growth. Understanding all of the tax programs and regulations can be overwhelming, so contact New Age Realty Group today and let the real estate experts assist you!

Philadelphia Tax Abatement Program: A Catalyst for Development

The Philadelphia Tax Abatement Program, initiated in 2000, aimed to stimulate new development, affordability, and revitalization in the city. For residential property owners, the program historically offered a 10-year 100% tax abatement on improvements related to new construction and rehabilitated properties. However, recent reforms have led to changes in the abatement's structure.

As of December 31, 2021, homeowners can still secure a full 100% tax abatement for 10 years by submitting their applications in time. For applications submitted after January 1, 2022, the abatement will see a 10% reduction each year over the subsequent nine years. This phased-out approach may impact the demand for new construction and rehabilitated properties in the long term. Conversely, it presents short-term opportunities for developers, as individuals rush to take advantage of the 10-year 100% abatement before the deadline.

Commercial & Industrial Tax Abatement: Funding the Neighborhood Preservation Initiative

In parallel with residential tax abatements, commercial and industrial property owners may qualify for a 10-year 100% tax abatement, subject to a 10% reduction. The estimated $83 million generated from this reduction will fund the Neighborhood Preservation Initiative, a $400 million bond program aimed at supporting affordable housing projects, first-time homebuyers, and neighborhood business corridor revitalization.

The initiative is projected to create $2.5 billion in economic activity, generate $71 million in new tax revenues over the first four years, and support 14,700 jobs. This shift in focus towards affordable housing presents a lucrative opportunity for developers to engage in projects that benefit from various subsidies, lowering overall costs.

Philadelphia's Current Year Installment Plan: A Lifeline for Property Owners

For those struggling to meet their yearly property tax obligations, the City of Philadelphia offers a Current Year Installment Plan. This program allows property owners to divide their annual tax bill into affordable monthly payments, preventing the risk of losing their homes due to non-payment. If participants complete the payment plan on time, any accrued interest or penalties will be forgiven.

Seniors and households based on income, regardless of age, can qualify for this program. The deadline to apply is March 31st, and early applications are encouraged to ensure timely processing. The program not only provides financial relief but also ensures automatic re-enrollment each year after approval.

Understanding Property Taxes in Philadelphia: A Holistic Approach

To comprehend the intricacies of property taxes in Philadelphia, it's essential to grasp the basics. Property taxes are assessed and collected by the City of Philadelphia and the School District of Philadelphia, funding various essential services. Real estate tax assessments are based on property value, and taxes are due annually on March 31st. Failure to pay by this deadline incurs penalties, with tax liens filed against the property after December 31st.

For assistance with payment plans or tax-related queries, individuals can contact the City of Philadelphia Revenue Department or consult with a Housing Counseling Agency. The department provides a range of resources, including real estate tax assistance programs, to support homeowners.

Foreclosure Lawsuit & Sheriff’s Sale Process: A Last Resort

In cases of unpaid property taxes, a foreclosure lawsuit may be initiated to foreclose the tax lien, ultimately leading to Sheriff's Sales. Continuous residential occupancy grants original owners the right of redemption within nine months after the new owner's Sheriff's Deed is recorded. Payment plan agreements offer an alternative for taxpayers experiencing financial hardships, allowing them to pay delinquent taxes in installments.

Commonly Asked Questions: A Quick Guide

Several frequently asked questions shed light on various scenarios related to property taxes in Philadelphia:

1. What if I cannot afford to pay my taxes? Payment plans, such as the Owner Occupied Payment Agreement, are available for eligible individuals under the City of Philadelphia's guidelines.

2. What if I never received a tax bill? It is the taxpayer's responsibility to request a tax bill from the City of Philadelphia Revenue Department and ensure the correct mailing address.

3. What if I already paid my taxes? Submit a copy of the paid receipt or canceled check to the City of Philadelphia Revenue Department.

4. What if my taxes were supposed to be paid by my mortgage company? Pay the delinquent tax and contact the mortgage company for reimbursement.

5. What if I receive a tax bill for taxes incurred after selling the property? Notify the Department of Revenue of the ownership change to rectify the issue.

6. What if I have filed bankruptcy and still owe delinquent taxes? Provide a copy of the Bankruptcy Petition to the City of Philadelphia Law Department.

7. How do I get an exemption? Apply for an exemption at the Philadelphia Office of Property Assessment by filling out the necessary forms.

8. "Tax Lien Sale" vs. City Accounts – what is the difference? In 1997, certain tax claims were sold to the Philadelphia Authority for Industrial Development (PAID), impacting the collection process for these accounts.

Conclusion

Navigating Philadelphia's real estate taxes requires a comprehensive understanding of the various programs, abatements, and payment options available to property owners. From the transformative Philadelphia Tax Abatement Program to the lifeline offered by the Current Year Installment Plan, residents have tools to manage their tax obligations. As the city focuses on affordable housing initiatives, developers can capitalize on subsidies and incentives to contribute to the community's growth. Understanding all of the tax programs and regulations can be overwhelming, so contact New Age Realty Group today and let the real estate experts assist you!

Buying your first home can be an exciting yet overwhelming process, especially when it comes to finding ways to make it affordable. Fortunately, there are several grants and assistance programs available for first-time homebuyers in Pennsylvania that can help make homeownership a reality. These programs offer financial aid in the form of grants, closing cost assistance, and down payment help. Below is a list of grants and assistance programs currently available to first-time buyers in Pennsylvania: Grants and Assistance Programs Available in PA Pennsylvania Housing Finance Agency (PHFA) Keystone Advantage Assistance Loan Program Provides up to $6,000 as down payment or closing cost assistance. Available for borrowers with a PHFA first mortgage. HOMEstead Downpayment and Closing Cost Assistance Loan Offers up to $10,000 in down payment and closing cost assistance. Loan is forgiven over a five-year period, provided the homeowner stays in the home. K-FIT (Keystone Forgivable in Ten Years Loan Program) Provides up to 5% of the lesser of the purchase price or appraised value as down payment and closing cost assistance. Forgiven over ten years, with no repayment required if eligibility requirements are met. FHA, USDA, and VA Loan Programs Offer down payment assistance and more lenient credit requirements. PA-based grant programs can often be paired with these loan types for added affordability. First Front Door Program Offers a grant of up to $5,000 to qualified first-time homebuyers. You must match the grant with your own savings; for every $1 you contribute, $3 is provided. For more detailed information on these grants and eligibility requirements, visit the Pennsylvania Housing Finance Agency (PHFA) website . These programs can help you bridge the gap between renting and owning by providing essential financial assistance. Whether you need help with a down payment or closing costs, there is likely a program to fit your needs as a first-time homebuyer in Pennsylvania. More Grants and Assistance Programs for First-Time Buyers in PA In addition to the Pennsylvania Housing Finance Agency programs, several other grants and assistance programs are available from different agencies and organizations, providing even more opportunities for first-time homebuyers in Pennsylvania: Community Development Block Grant (CDBG) Program Funded by the U.S. Department of Housing and Urban Development (HUD). Provides funding to local governments for affordable housing initiatives, including down payment assistance for low- to moderate-income first-time buyers. Availability and amount vary by municipality, so check with your local city or county government for opportunities. Neighborhood Assistance Program (NAP) Offers tax credits to businesses that invest in affordable housing initiatives, which can help first-time buyers indirectly by funding community housing projects. This program is administered through the Pennsylvania Department of Community and Economic Development (DCED). Federal Home Loan Bank (FHLB) Affordable Housing Programs The First Front Door (FFD) program, offered through FHLB, provides eligible first-time buyers with a grant of up to $5,000 to assist with a down payment and closing costs. Participating lenders and financial institutions provide the funding, so buyers need to work with a participating bank. Local Housing Authorities Various local housing authorities across Pennsylvania offer down payment assistance programs and grants. Examples include the Philadelphia Housing Development Corporation (PHDC), which offers the Philly First Home program that provides up to $10,000 (or 6% of the home purchase price) to assist first-time buyers with down payments and closing costs in Philadelphia. U.S. Department of Agriculture (USDA) Loans and Grants The USDA offers loans and grants to promote homeownership in rural areas of Pennsylvania. Eligible buyers can receive 100% financing, and grants can help cover closing costs or home repairs. Good Neighbor Next Door Program (HUD) This HUD program offers a 50% discount on the list price of a home for teachers, law enforcement officers, firefighters, and emergency medical technicians in designated revitalization areas. Buyers must commit to living in the home for at least 36 months. Housing Counseling Agencies Non-profit agencies in Pennsylvania, like NeighborWorks America affiliates, may offer grants or forgivable loans to assist with down payments or closing costs. These agencies often provide educational courses, which can be a requirement for qualifying for other grant programs. For more information, visit: Pennsylvania Department of Community and Economic Development (DCED) Philadelphia Housing Development Corporation (PHDC) Federal Home Loan Bank (FHLB) With a combination of state, federal, and local grants, first-time buyers in Pennsylvania can save up to $31,000 or more. Whether you're looking to reduce down payment costs, get closing cost assistance, or find affordable financing options, these programs are designed to help make your dream of homeownership come true. Authored by: Armand Gjeka, Realtor Sources: -https://phdcphila.org -https://www.phfa.org -https://dced.pa.gov/ -https://www.fhlb.com/

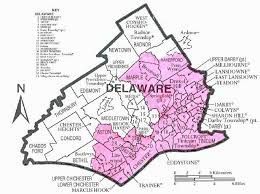

If your Delaware County, PA house is facing foreclosure and you want to avoid it, or if you just need to sell your house quickly for another reason (such as inheriting a house, relocating, losing your job, or if your agent can’t sell your house), then finding a buyer to purchase your Delaware County PA … Continued

Time and money are crucial factors when you are selling your home. If you need to sell your Delaware County house fast, there are local professional home buying companies who pay cash for homes in Delaware County, PA. Let’s explore how you can sell your local Delaware County house quickly and get cash without having … Continued

Foreclosure is a difficult and overwhelming experience for any family facing it, regardless of the reasons behind the situation. Today, we will explore the effects of foreclosure in Delaware County, PA, and what local homeowners should be aware of. We’ll discuss both the impacts of foreclosure and ways to mitigate them. Foreclosure Effects in Delaware … Continued