How to Become a Philadelphia Landlord in 2024

February 12, 2024

How to Become a Philadelphia Landlord in 2024

New Age Realty Group, Inc.

February 12, 2024

Welcome to the world of Philadelphia real estate, where there are a variety of opportunities for investing in properties, and where becoming a landlord is a thrilling journey. We are New Age Realty Group, here to help you navigate the world of real estate. We've put together a complete guide to help answer important questions and guide you through the necessary steps to become a landlord in the City of Brotherly Love!

Why Become a Philadelphia Landlord?

Philadelphia presents a range of property investment opportunities, with low property taxes compared to other states and plenty of up-and-coming neighborhoods. With a steady influx of young professionals seeking rental properties, the demand for housing is high. Before delving into the responsibilities of a landlord, it's crucial to find the right investment opportunity. Collaborating with a local real estate agent familiar with the city can provide valuable insights and guidance.

Ensuring Compliance with Philadelphia Regulations

Before transforming your property into a rental unit, it is important to adhere to the regulations set forth by the city. This includes obtaining the necessary licenses, ensuring zoning compliance, and addressing key safety and health requirements. Now, let's delve into the top questions prospective landlords often ask.

1. Do you need a license to be a landlord in Philadelphia?

Yes, as a landlord in Philadelphia, you need several licenses to operate legally. These include the Commercial Activity License (CAL) or Owner-Occupied Housing License, Business Income & Receipts Tax (BIRT), Rental License, and High-Rise License if applicable. Zoning approval is also essential, demonstrating that your property is properly zoned for dwelling use.

2. Is Philadelphia a landlord-friendly city?

Philadelphia, while having specific regulations in place, provides a framework for landlords to operate. The city emphasizes compliance with housing regulations and provides guidelines to ensure a fair and safe environment for both landlords and tenants.

3. Is it easy to become a landlord in Philadelphia?

Becoming a landlord in Philadelphia involves a series of steps and compliance with regulations. While the city has established procedures to ensure safe and fair housing, the process requires diligence and attention to detail. By following our comprehensive guide, you'll navigate the complexities efficiently and position yourself as a responsible and successful landlord.

Step-by-Step Guide to Becoming a Philadelphia Landlord

To assist you on this journey, we've synthesized information from various sources, including the City of Philadelphia's official website and expert advice from real estate professionals.

Step 1: Get Your Business Income & Receipts Tax (BIRT) Account Number

Before diving into the world of property management, it's essential to file a Business Income & Receipts Tax (BIRT) return through the Philadelphia Department of Revenue. This applies to any individual or entity engaged in for-profit activity within the city.

Step 2: Create Your eClipse Account

Streamline the application process by creating an eClipse account. This platform allows you to apply for permits, schedule inspections, and seek approvals from multiple departments simultaneously.

Step 3: Get Your Commercial Activity License

Obtain a Commercial Activity License through the Philadelphia L&I, linking all your businesses and serving as a prerequisite for other licenses.

Step 4: Ensure Compliance with Lead Paint Disclosure and Certification Law

Stay informed about the Lead Paint Disclosure and Certification Law, which impacts properties built prior to 1978. Obtain the required certifications to proceed with leasing.

Step 5: Obtain Your Housing Rental License

For each unit you plan to rent out, secure a Housing Rental License. Ensure compliance with zoning regulations and, for multi-unit properties, gain Zoning Approval.

Step 6: Obtain a Certificate of Rental Suitability

Before each lease begins, provide tenants with a Certificate of Rental Suitability issued by L&I, verifying the property's suitability for habitation.

Step 7: Register for the PGW Landlord Cooperation Program

Enhance property management efficiency by registering for the PGW Landlord Cooperation Program, facilitating communication with the gas utility provider.

Understanding Landlord-Tenant Law in Philadelphia

Becoming a successful landlord in Philadelphia requires a deep understanding of local landlord-tenant laws. Familiarize yourself with the rights and responsibilities outlined in the Partners in Good Housing guidebook. Additionally, comply with the Renters Access Act tenant screening guidelines, ensuring a fair and non-discriminatory tenant selection process.

Conclusion

Congratulations on taking the first steps toward becoming a Philadelphia landlord. Philadelphia's real estate landscape is rich with opportunities, and by following this comprehensive guide, you'll be well-equipped to navigate the legal requirements, ensure property compliance, and create a positive landlord-tenant relationship. Remember, knowledge is key, and as you embark on this journey, stay informed and connected with local resources to make your venture a success. If you own Philadelphia real estate, contact New Age Realty Group for all your management need, and sit back while your property generates income!

Why Become a Philadelphia Landlord?

Philadelphia presents a range of property investment opportunities, with low property taxes compared to other states and plenty of up-and-coming neighborhoods. With a steady influx of young professionals seeking rental properties, the demand for housing is high. Before delving into the responsibilities of a landlord, it's crucial to find the right investment opportunity. Collaborating with a local real estate agent familiar with the city can provide valuable insights and guidance.

Ensuring Compliance with Philadelphia Regulations

Before transforming your property into a rental unit, it is important to adhere to the regulations set forth by the city. This includes obtaining the necessary licenses, ensuring zoning compliance, and addressing key safety and health requirements. Now, let's delve into the top questions prospective landlords often ask.

1. Do you need a license to be a landlord in Philadelphia?

Yes, as a landlord in Philadelphia, you need several licenses to operate legally. These include the Commercial Activity License (CAL) or Owner-Occupied Housing License, Business Income & Receipts Tax (BIRT), Rental License, and High-Rise License if applicable. Zoning approval is also essential, demonstrating that your property is properly zoned for dwelling use.

2. Is Philadelphia a landlord-friendly city?

Philadelphia, while having specific regulations in place, provides a framework for landlords to operate. The city emphasizes compliance with housing regulations and provides guidelines to ensure a fair and safe environment for both landlords and tenants.

3. Is it easy to become a landlord in Philadelphia?

Becoming a landlord in Philadelphia involves a series of steps and compliance with regulations. While the city has established procedures to ensure safe and fair housing, the process requires diligence and attention to detail. By following our comprehensive guide, you'll navigate the complexities efficiently and position yourself as a responsible and successful landlord.

Step-by-Step Guide to Becoming a Philadelphia Landlord

To assist you on this journey, we've synthesized information from various sources, including the City of Philadelphia's official website and expert advice from real estate professionals.

Step 1: Get Your Business Income & Receipts Tax (BIRT) Account Number

Before diving into the world of property management, it's essential to file a Business Income & Receipts Tax (BIRT) return through the Philadelphia Department of Revenue. This applies to any individual or entity engaged in for-profit activity within the city.

Step 2: Create Your eClipse Account

Streamline the application process by creating an eClipse account. This platform allows you to apply for permits, schedule inspections, and seek approvals from multiple departments simultaneously.

Step 3: Get Your Commercial Activity License

Obtain a Commercial Activity License through the Philadelphia L&I, linking all your businesses and serving as a prerequisite for other licenses.

Step 4: Ensure Compliance with Lead Paint Disclosure and Certification Law

Stay informed about the Lead Paint Disclosure and Certification Law, which impacts properties built prior to 1978. Obtain the required certifications to proceed with leasing.

Step 5: Obtain Your Housing Rental License

For each unit you plan to rent out, secure a Housing Rental License. Ensure compliance with zoning regulations and, for multi-unit properties, gain Zoning Approval.

Step 6: Obtain a Certificate of Rental Suitability

Before each lease begins, provide tenants with a Certificate of Rental Suitability issued by L&I, verifying the property's suitability for habitation.

Step 7: Register for the PGW Landlord Cooperation Program

Enhance property management efficiency by registering for the PGW Landlord Cooperation Program, facilitating communication with the gas utility provider.

Understanding Landlord-Tenant Law in Philadelphia

Becoming a successful landlord in Philadelphia requires a deep understanding of local landlord-tenant laws. Familiarize yourself with the rights and responsibilities outlined in the Partners in Good Housing guidebook. Additionally, comply with the Renters Access Act tenant screening guidelines, ensuring a fair and non-discriminatory tenant selection process.

Conclusion

Congratulations on taking the first steps toward becoming a Philadelphia landlord. Philadelphia's real estate landscape is rich with opportunities, and by following this comprehensive guide, you'll be well-equipped to navigate the legal requirements, ensure property compliance, and create a positive landlord-tenant relationship. Remember, knowledge is key, and as you embark on this journey, stay informed and connected with local resources to make your venture a success. If you own Philadelphia real estate, contact New Age Realty Group for all your management need, and sit back while your property generates income!

Buying your first home can be an exciting yet overwhelming process, especially when it comes to finding ways to make it affordable. Fortunately, there are several grants and assistance programs available for first-time homebuyers in Pennsylvania that can help make homeownership a reality. These programs offer financial aid in the form of grants, closing cost assistance, and down payment help. Below is a list of grants and assistance programs currently available to first-time buyers in Pennsylvania: Grants and Assistance Programs Available in PA Pennsylvania Housing Finance Agency (PHFA) Keystone Advantage Assistance Loan Program Provides up to $6,000 as down payment or closing cost assistance. Available for borrowers with a PHFA first mortgage. HOMEstead Downpayment and Closing Cost Assistance Loan Offers up to $10,000 in down payment and closing cost assistance. Loan is forgiven over a five-year period, provided the homeowner stays in the home. K-FIT (Keystone Forgivable in Ten Years Loan Program) Provides up to 5% of the lesser of the purchase price or appraised value as down payment and closing cost assistance. Forgiven over ten years, with no repayment required if eligibility requirements are met. FHA, USDA, and VA Loan Programs Offer down payment assistance and more lenient credit requirements. PA-based grant programs can often be paired with these loan types for added affordability. First Front Door Program Offers a grant of up to $5,000 to qualified first-time homebuyers. You must match the grant with your own savings; for every $1 you contribute, $3 is provided. For more detailed information on these grants and eligibility requirements, visit the Pennsylvania Housing Finance Agency (PHFA) website . These programs can help you bridge the gap between renting and owning by providing essential financial assistance. Whether you need help with a down payment or closing costs, there is likely a program to fit your needs as a first-time homebuyer in Pennsylvania. More Grants and Assistance Programs for First-Time Buyers in PA In addition to the Pennsylvania Housing Finance Agency programs, several other grants and assistance programs are available from different agencies and organizations, providing even more opportunities for first-time homebuyers in Pennsylvania: Community Development Block Grant (CDBG) Program Funded by the U.S. Department of Housing and Urban Development (HUD). Provides funding to local governments for affordable housing initiatives, including down payment assistance for low- to moderate-income first-time buyers. Availability and amount vary by municipality, so check with your local city or county government for opportunities. Neighborhood Assistance Program (NAP) Offers tax credits to businesses that invest in affordable housing initiatives, which can help first-time buyers indirectly by funding community housing projects. This program is administered through the Pennsylvania Department of Community and Economic Development (DCED). Federal Home Loan Bank (FHLB) Affordable Housing Programs The First Front Door (FFD) program, offered through FHLB, provides eligible first-time buyers with a grant of up to $5,000 to assist with a down payment and closing costs. Participating lenders and financial institutions provide the funding, so buyers need to work with a participating bank. Local Housing Authorities Various local housing authorities across Pennsylvania offer down payment assistance programs and grants. Examples include the Philadelphia Housing Development Corporation (PHDC), which offers the Philly First Home program that provides up to $10,000 (or 6% of the home purchase price) to assist first-time buyers with down payments and closing costs in Philadelphia. U.S. Department of Agriculture (USDA) Loans and Grants The USDA offers loans and grants to promote homeownership in rural areas of Pennsylvania. Eligible buyers can receive 100% financing, and grants can help cover closing costs or home repairs. Good Neighbor Next Door Program (HUD) This HUD program offers a 50% discount on the list price of a home for teachers, law enforcement officers, firefighters, and emergency medical technicians in designated revitalization areas. Buyers must commit to living in the home for at least 36 months. Housing Counseling Agencies Non-profit agencies in Pennsylvania, like NeighborWorks America affiliates, may offer grants or forgivable loans to assist with down payments or closing costs. These agencies often provide educational courses, which can be a requirement for qualifying for other grant programs. For more information, visit: Pennsylvania Department of Community and Economic Development (DCED) Philadelphia Housing Development Corporation (PHDC) Federal Home Loan Bank (FHLB) With a combination of state, federal, and local grants, first-time buyers in Pennsylvania can save up to $31,000 or more. Whether you're looking to reduce down payment costs, get closing cost assistance, or find affordable financing options, these programs are designed to help make your dream of homeownership come true. Authored by: Armand Gjeka, Realtor Sources: -https://phdcphila.org -https://www.phfa.org -https://dced.pa.gov/ -https://www.fhlb.com/

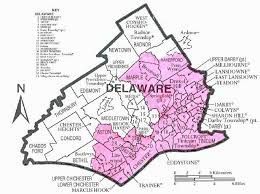

If your Delaware County, PA house is facing foreclosure and you want to avoid it, or if you just need to sell your house quickly for another reason (such as inheriting a house, relocating, losing your job, or if your agent can’t sell your house), then finding a buyer to purchase your Delaware County PA … Continued

Time and money are crucial factors when you are selling your home. If you need to sell your Delaware County house fast, there are local professional home buying companies who pay cash for homes in Delaware County, PA. Let’s explore how you can sell your local Delaware County house quickly and get cash without having … Continued

Foreclosure is a difficult and overwhelming experience for any family facing it, regardless of the reasons behind the situation. Today, we will explore the effects of foreclosure in Delaware County, PA, and what local homeowners should be aware of. We’ll discuss both the impacts of foreclosure and ways to mitigate them. Foreclosure Effects in Delaware … Continued