Philadelphia's Best Places to Invest in Real Estate 2024

nicole • February 22, 2024

Philadelphia's Best Places to Invest in Real Estate 2024

New Age Realty Group, Inc.

February 22, 2024

Philadelphia, with its rich cultural history and diverse neighborhoods, is emerging as a hotspot for real estate investment in 2024. This article explores the factors that make Philadelphia an attractive destination for investors and delves into specific neighborhoods with promising growth potential.

Philadelphia's Economic Landscape

Philadelphia's real estate market is backed by a robust economy spanning healthcare, finance, education, and technology. The city's strategic location in the Northeast corridor, with excellent transportation infrastructure, has led to a steady influx of residents. The Philadelphia Metro’s median sales price was $340,000 as of January 2024, up 8.3% from last year.

1. Is Philadelphia a good place to buy investment property?

Philadelphia stands out as an excellent place to buy investment property for several reasons. The city's stable job market, diverse economy, and growing population create a consistent demand for housing. Additionally, the affordability of Philadelphia compared to other East Coast cities provides investors with an attractive opportunity to enter the market with the potential for significant returns.

2. What areas in Philadelphia are up and coming?

Several neighborhoods in Philadelphia are up and coming, offering investors the potential for significant returns. Fishtown, Brewerytown, Olde Kensington, Port Richmond, Chestnut Hill, Logan Square, and Strawberry Mansion are among the top contenders. These areas have witnessed revitalization efforts, attracting a diverse range of residents and contributing to property value appreciation.

3. What is the fastest growing area in Philadelphia?

Fishtown is currently one of the fastest-growing areas in Philadelphia. The neighborhood's popularity among young professionals and artists has led to an increase in home prices over the previous year. The ongoing development projects, such as the Schuylkill Yards Innovation District and the East Market development, contribute to the area's rapid growth.

Top Neighborhoods for Real Estate Investments in Philadelphia

Philadelphia offers a diverse range of neighborhoods, each with unique characteristics and investment potential. Let's explore some of the top neighborhoods for real estate investments in 2024.

1. Fishtown

Situated along the Delaware River, Fishtown has become a magnet for the city's young and artistic demographic. With a steady increase in home prices over the past few years, Fishtown is an attractive option for real estate investors.

2. Brewerytown

Located in North Philadelphia along the Schuylkill River, Brewerytown has garnered attention from investors. Former breweries have been transformed into modern housing, providing residents with proximity to Center City at relatively lower prices.

3. Olde Kensington

Between Fishtown and Northern Liberties, Olde Kensington has undergone significant revitalization, attracting millennial renters and homebuyers. The conversion of old factories into modern living spaces has contributed to increased property values.

4. Port Richmond

Traditionally a working-class neighborhood with a deep-rooted Polish community, Port Richmond is experiencing a revitalization, appealing to young professionals seeking a close-knit community. Its location on the Delaware River adds to its appeal.

5. Chestnut Hill

Positioned as Philadelphia's garden district, Chestnut Hill is an affluent neighborhood with higher home prices. The area's low crime rates, proximity to prestigious educational institutions, and attractive amenities make it an appealing option for real estate investors.

6. Logan Square

Home to iconic landmarks like The Barnes Foundation and Philadelphia's City Hall, Logan Square remains consistently popular. While property values and rental prices are higher than average, the neighborhood offers potential for higher returns over time.

7. Strawberry Mansion

East of Fairmount Park in North Philly, Strawberry Mansion is undergoing a transition with revitalization efforts supported by the Neighborhood Transformation Initiative. Affordable housing options make it an attractive investment with potential returns as the community continues to develop.

Why You Should be Investing in Philadelphia Real Estate

Philadelphia's unique combination of historical charm, economic diversity, and affordable opportunities positions it as an excellent destination for real estate investment. Let's delve deeper into the reasons why investors should consider Philadelphia for their real estate ventures.

1. Consistent Demand for Housing

Philadelphia's growing population, driven by young professionals, students, and families attracted to educational institutions and cultural amenities, creates a consistent demand for housing. This demand spans various property types, including rental apartments, family homes, and student housing, providing investors with a reliable income stream.

2. Location and Connectivity

The city's strategic location along the East Coast, with easy access to major metropolitan areas like New York City and Washington D.C., enhances its investment appeal. Investors benefit from expanded market opportunities and a broader pool of potential residents. Philadelphia's excellent transportation infrastructure, including an international airport and extensive public transit, further supports convenient connectivity within the city and to neighboring regions.

3. Affordability

One of Philadelphia's standout features is its affordability in comparison to other major East Coast cities. Investors can find promising opportunities without facing the exorbitant price tags associated with markets like New York or Washington D.C. This affordability, coupled with strong market fundamentals, creates a prime investment landscape, allowing for a lower barrier to entry and the potential for significant returns.

4. Stepping into History

Philadelphia's historical significance is evident in its colonial-era buildings and preserved architectural heritage. For investors interested in restoring and repurposing properties, the city provides a distinctive backdrop. The charm of neighborhoods like Old City, Northern Liberties, and Chestnut Hill offers a unique blend of history and modern living.

5. Diverse Landscape

The city's diverse neighborhoods cater to various preferences, ensuring a vibrant and varied real estate landscape. Each neighborhood has its own character and allure, contributing to the city's economic diversity. From the bustling Center City to the artsy Fishtown, investors can find opportunities that align with their investment goals.

6. Cultural Vibrance and Livability

Philadelphia's cultural vibrancy adds to its investment allure, boasting world-class museums, art galleries, music venues, and theaters. The city's commitment to cultural enrichment, exemplified by initiatives like the Mural Arts Program, contributes to its livability. Combined with abundant green spaces and a walkable layout, Philadelphia stands out as a highly livable city, enhancing its investment potential.

Conclusion

In summary, Philadelphia offers a compelling opportunity for real estate investment, blending historical significance, vibrant neighborhoods, economic diversity, and a strong rental market. The city's affordability, strategic location, and cultural attractions create a favorable investment landscape that provides stability and growth potential. Whether investors are interested in historic property restoration, capitalizing on the rental market, or tapping into the city's economic diversity, Philadelphia presents an attractive opportunity to invest in a city that embraces its unique characteristics. To get started investing in your future, contact New Age Realty Group, Inc. today!

Philadelphia's Economic Landscape

Philadelphia's real estate market is backed by a robust economy spanning healthcare, finance, education, and technology. The city's strategic location in the Northeast corridor, with excellent transportation infrastructure, has led to a steady influx of residents. The Philadelphia Metro’s median sales price was $340,000 as of January 2024, up 8.3% from last year.

1. Is Philadelphia a good place to buy investment property?

Philadelphia stands out as an excellent place to buy investment property for several reasons. The city's stable job market, diverse economy, and growing population create a consistent demand for housing. Additionally, the affordability of Philadelphia compared to other East Coast cities provides investors with an attractive opportunity to enter the market with the potential for significant returns.

2. What areas in Philadelphia are up and coming?

Several neighborhoods in Philadelphia are up and coming, offering investors the potential for significant returns. Fishtown, Brewerytown, Olde Kensington, Port Richmond, Chestnut Hill, Logan Square, and Strawberry Mansion are among the top contenders. These areas have witnessed revitalization efforts, attracting a diverse range of residents and contributing to property value appreciation.

3. What is the fastest growing area in Philadelphia?

Fishtown is currently one of the fastest-growing areas in Philadelphia. The neighborhood's popularity among young professionals and artists has led to an increase in home prices over the previous year. The ongoing development projects, such as the Schuylkill Yards Innovation District and the East Market development, contribute to the area's rapid growth.

Top Neighborhoods for Real Estate Investments in Philadelphia

Philadelphia offers a diverse range of neighborhoods, each with unique characteristics and investment potential. Let's explore some of the top neighborhoods for real estate investments in 2024.

1. Fishtown

Situated along the Delaware River, Fishtown has become a magnet for the city's young and artistic demographic. With a steady increase in home prices over the past few years, Fishtown is an attractive option for real estate investors.

2. Brewerytown

Located in North Philadelphia along the Schuylkill River, Brewerytown has garnered attention from investors. Former breweries have been transformed into modern housing, providing residents with proximity to Center City at relatively lower prices.

3. Olde Kensington

Between Fishtown and Northern Liberties, Olde Kensington has undergone significant revitalization, attracting millennial renters and homebuyers. The conversion of old factories into modern living spaces has contributed to increased property values.

4. Port Richmond

Traditionally a working-class neighborhood with a deep-rooted Polish community, Port Richmond is experiencing a revitalization, appealing to young professionals seeking a close-knit community. Its location on the Delaware River adds to its appeal.

5. Chestnut Hill

Positioned as Philadelphia's garden district, Chestnut Hill is an affluent neighborhood with higher home prices. The area's low crime rates, proximity to prestigious educational institutions, and attractive amenities make it an appealing option for real estate investors.

6. Logan Square

Home to iconic landmarks like The Barnes Foundation and Philadelphia's City Hall, Logan Square remains consistently popular. While property values and rental prices are higher than average, the neighborhood offers potential for higher returns over time.

7. Strawberry Mansion

East of Fairmount Park in North Philly, Strawberry Mansion is undergoing a transition with revitalization efforts supported by the Neighborhood Transformation Initiative. Affordable housing options make it an attractive investment with potential returns as the community continues to develop.

Why You Should be Investing in Philadelphia Real Estate

Philadelphia's unique combination of historical charm, economic diversity, and affordable opportunities positions it as an excellent destination for real estate investment. Let's delve deeper into the reasons why investors should consider Philadelphia for their real estate ventures.

1. Consistent Demand for Housing

Philadelphia's growing population, driven by young professionals, students, and families attracted to educational institutions and cultural amenities, creates a consistent demand for housing. This demand spans various property types, including rental apartments, family homes, and student housing, providing investors with a reliable income stream.

2. Location and Connectivity

The city's strategic location along the East Coast, with easy access to major metropolitan areas like New York City and Washington D.C., enhances its investment appeal. Investors benefit from expanded market opportunities and a broader pool of potential residents. Philadelphia's excellent transportation infrastructure, including an international airport and extensive public transit, further supports convenient connectivity within the city and to neighboring regions.

3. Affordability

One of Philadelphia's standout features is its affordability in comparison to other major East Coast cities. Investors can find promising opportunities without facing the exorbitant price tags associated with markets like New York or Washington D.C. This affordability, coupled with strong market fundamentals, creates a prime investment landscape, allowing for a lower barrier to entry and the potential for significant returns.

4. Stepping into History

Philadelphia's historical significance is evident in its colonial-era buildings and preserved architectural heritage. For investors interested in restoring and repurposing properties, the city provides a distinctive backdrop. The charm of neighborhoods like Old City, Northern Liberties, and Chestnut Hill offers a unique blend of history and modern living.

5. Diverse Landscape

The city's diverse neighborhoods cater to various preferences, ensuring a vibrant and varied real estate landscape. Each neighborhood has its own character and allure, contributing to the city's economic diversity. From the bustling Center City to the artsy Fishtown, investors can find opportunities that align with their investment goals.

6. Cultural Vibrance and Livability

Philadelphia's cultural vibrancy adds to its investment allure, boasting world-class museums, art galleries, music venues, and theaters. The city's commitment to cultural enrichment, exemplified by initiatives like the Mural Arts Program, contributes to its livability. Combined with abundant green spaces and a walkable layout, Philadelphia stands out as a highly livable city, enhancing its investment potential.

Conclusion

In summary, Philadelphia offers a compelling opportunity for real estate investment, blending historical significance, vibrant neighborhoods, economic diversity, and a strong rental market. The city's affordability, strategic location, and cultural attractions create a favorable investment landscape that provides stability and growth potential. Whether investors are interested in historic property restoration, capitalizing on the rental market, or tapping into the city's economic diversity, Philadelphia presents an attractive opportunity to invest in a city that embraces its unique characteristics. To get started investing in your future, contact New Age Realty Group, Inc. today!

Buying your first home can be an exciting yet overwhelming process, especially when it comes to finding ways to make it affordable. Fortunately, there are several grants and assistance programs available for first-time homebuyers in Pennsylvania that can help make homeownership a reality. These programs offer financial aid in the form of grants, closing cost assistance, and down payment help. Below is a list of grants and assistance programs currently available to first-time buyers in Pennsylvania: Grants and Assistance Programs Available in PA Pennsylvania Housing Finance Agency (PHFA) Keystone Advantage Assistance Loan Program Provides up to $6,000 as down payment or closing cost assistance. Available for borrowers with a PHFA first mortgage. HOMEstead Downpayment and Closing Cost Assistance Loan Offers up to $10,000 in down payment and closing cost assistance. Loan is forgiven over a five-year period, provided the homeowner stays in the home. K-FIT (Keystone Forgivable in Ten Years Loan Program) Provides up to 5% of the lesser of the purchase price or appraised value as down payment and closing cost assistance. Forgiven over ten years, with no repayment required if eligibility requirements are met. FHA, USDA, and VA Loan Programs Offer down payment assistance and more lenient credit requirements. PA-based grant programs can often be paired with these loan types for added affordability. First Front Door Program Offers a grant of up to $5,000 to qualified first-time homebuyers. You must match the grant with your own savings; for every $1 you contribute, $3 is provided. For more detailed information on these grants and eligibility requirements, visit the Pennsylvania Housing Finance Agency (PHFA) website . These programs can help you bridge the gap between renting and owning by providing essential financial assistance. Whether you need help with a down payment or closing costs, there is likely a program to fit your needs as a first-time homebuyer in Pennsylvania. More Grants and Assistance Programs for First-Time Buyers in PA In addition to the Pennsylvania Housing Finance Agency programs, several other grants and assistance programs are available from different agencies and organizations, providing even more opportunities for first-time homebuyers in Pennsylvania: Community Development Block Grant (CDBG) Program Funded by the U.S. Department of Housing and Urban Development (HUD). Provides funding to local governments for affordable housing initiatives, including down payment assistance for low- to moderate-income first-time buyers. Availability and amount vary by municipality, so check with your local city or county government for opportunities. Neighborhood Assistance Program (NAP) Offers tax credits to businesses that invest in affordable housing initiatives, which can help first-time buyers indirectly by funding community housing projects. This program is administered through the Pennsylvania Department of Community and Economic Development (DCED). Federal Home Loan Bank (FHLB) Affordable Housing Programs The First Front Door (FFD) program, offered through FHLB, provides eligible first-time buyers with a grant of up to $5,000 to assist with a down payment and closing costs. Participating lenders and financial institutions provide the funding, so buyers need to work with a participating bank. Local Housing Authorities Various local housing authorities across Pennsylvania offer down payment assistance programs and grants. Examples include the Philadelphia Housing Development Corporation (PHDC), which offers the Philly First Home program that provides up to $10,000 (or 6% of the home purchase price) to assist first-time buyers with down payments and closing costs in Philadelphia. U.S. Department of Agriculture (USDA) Loans and Grants The USDA offers loans and grants to promote homeownership in rural areas of Pennsylvania. Eligible buyers can receive 100% financing, and grants can help cover closing costs or home repairs. Good Neighbor Next Door Program (HUD) This HUD program offers a 50% discount on the list price of a home for teachers, law enforcement officers, firefighters, and emergency medical technicians in designated revitalization areas. Buyers must commit to living in the home for at least 36 months. Housing Counseling Agencies Non-profit agencies in Pennsylvania, like NeighborWorks America affiliates, may offer grants or forgivable loans to assist with down payments or closing costs. These agencies often provide educational courses, which can be a requirement for qualifying for other grant programs. For more information, visit: Pennsylvania Department of Community and Economic Development (DCED) Philadelphia Housing Development Corporation (PHDC) Federal Home Loan Bank (FHLB) With a combination of state, federal, and local grants, first-time buyers in Pennsylvania can save up to $31,000 or more. Whether you're looking to reduce down payment costs, get closing cost assistance, or find affordable financing options, these programs are designed to help make your dream of homeownership come true. Authored by: Armand Gjeka, Realtor Sources: -https://phdcphila.org -https://www.phfa.org -https://dced.pa.gov/ -https://www.fhlb.com/

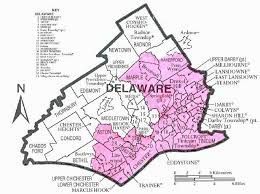

If your Delaware County, PA house is facing foreclosure and you want to avoid it, or if you just need to sell your house quickly for another reason (such as inheriting a house, relocating, losing your job, or if your agent can’t sell your house), then finding a buyer to purchase your Delaware County PA … Continued

Time and money are crucial factors when you are selling your home. If you need to sell your Delaware County house fast, there are local professional home buying companies who pay cash for homes in Delaware County, PA. Let’s explore how you can sell your local Delaware County house quickly and get cash without having … Continued

Foreclosure is a difficult and overwhelming experience for any family facing it, regardless of the reasons behind the situation. Today, we will explore the effects of foreclosure in Delaware County, PA, and what local homeowners should be aware of. We’ll discuss both the impacts of foreclosure and ways to mitigate them. Foreclosure Effects in Delaware … Continued